- Accounting Services

- Written By Namita Bhagat

Is ‘Offshore Accounting Services’ a Good Idea for My CPA Firm?

14-Aug-2023 . 6 min read

Are you unsure about hiring an offshore accounting services provider for your CPA firm?

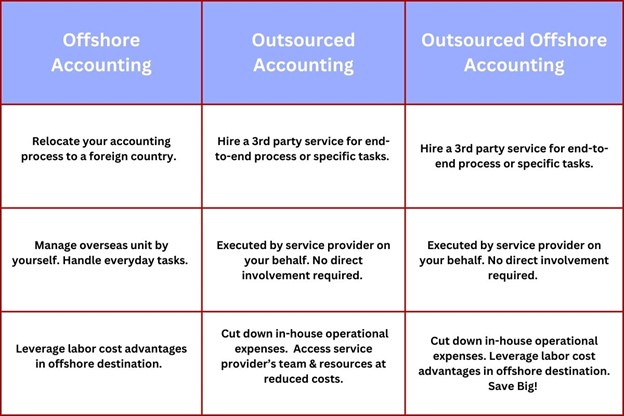

Setting up an offshore accounting department is a significant strategic move for CPAs. The decision becomes even more significant when you decide to outsource it.

You may even wonder: Is outsourcing my client accounting to an offshore accounting partner truly a good move? Or should I stick with an in-house operation or consider a local accounting service near me?

We get you!

Let’s explore the viability of offshoring your CPA accounting operations through outsourcing. We’ll uncover critical insights to help you navigate this path successfully.

Offshore Accounting: What It Means For Your CPA Firm

Essentially, accounting offshore involves relocating the process to a foreign country.

A CPA firm may build its captive division or join forces with a client accounting services (CAS) provider, who oversees the process on behalf of its clients.

In the latter scenario, you’ll not need to get involved in day-to-day operations.

Your service provider’s team members handle the time-consuming routine accounting tasks. They also ensure timely delivery and reporting. So, you achieve streamlined workflows without getting tied up and overwhelmed.

Despite this undeniable advantage, some firms are reluctant to hire foreign-based third-party accountants. They usually have apprehensions about the quality of operation and service delivery.

But, it is not an issue when you hire a proficient accounting solutions provider.

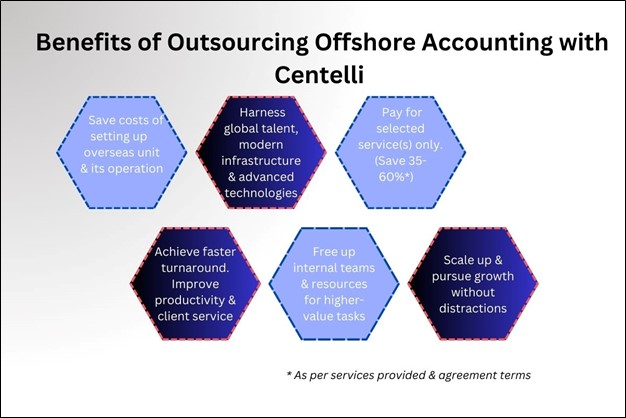

Key Benefits of Offshoring Accounting via Outsourcing

Cost-savings, enhanced productivity and scalability are among the most appealing features of the outsourcing-offshoring model.

Here are some key benefits of outsourcing offshore accounting services, in detail:

1. Cost Efficiency

First, outsourcing to an offshore destination means you can skip building in-house infrastructure. Plus, you can also save a significant amount of money on operational overheads.

India, Mexico, and the Philippines are some globally-known business process outsourcing (BPO) hubs.

Additionally, you can save both time and expenses on hiring and training.

The offshore service provider maintains a dedicated team and required assets. You don’t have to spend your resources on recruitment and retention.

So, whether you’re working with limited resources or aiming to redirect efforts from internal accounting processes to other critical aspects of your CPA practice – outsourcing to an offshore site can be an ideal option.

2. Productivity and Scalability

In addition to time and cost efficiencies, outsourcing-offshoring model can also help increase productivity.

You can utilize in-house capacity to accommodate more clients by transferring workloads to offshore accountants. So, your CPA firm can now not only expand its client base but also scale up.

As the outsourced team handles routine tasks, your in-house team can transition to more specialized and value-added services. With more clients and higher-value services, you can generate better revenues as well.

Therefore, offshore accounting outsourcing can serve as a springboard for effectively growing your CPA practice.

3. Global Talent Access

Outsourcing offshore enables access to a more diversified accounting workforce beyond geographical boundaries.

Is your CPA firm situated in the UK, US, Canada, Australia, and elsewhere where English is a corporate language?

Prominent global BPO hubs have an ample workforce fluent in the language. And they offer comparable skills and specialized knowledge at a fraction of the cost you would pay back home.

Potential Challenges of Outsourcing Offshore Accounting

While there are numerous benefits to outsourcing offshore accounting for CPAs, you should also take note of some challenges, such as:

1. Quality Control

Upholding the quality standards of client accounting services is crucial for a CPA firm. You can address this concern by clearly communicating your expectations to the offshore team. Typically, quality control is part of the best practices of a good accounting outsourcing services provider.

2. Data Security

While dealing with sensitive financial information, data breaches and loss can be primary concerns. Make sure your accounting services partner follows strict security measures for data security and safety.

3. Time Zone Difference

Working with an offshore team in different time zones can seem challenging. However, in today’s digital age, which enables seamless collaboration, time zone differences can also be advantageous as they enable round-the-clock operations.

Why Hiring Offshore Accounting Services Is a Good Idea for CPAs

Despite a few challenges, partnerning with an offshore F&A service provider from top outsourcing hubs like the Philippines, India, and Vietnam can be overall rewarding as you can access expertise without spending exorbitant amounts.

So, if you want to capitalize on the collective benefits of accounting outsourcing and offshoring for your CPA firm, don’t overlook this:

- Execution becomes easier when you are clear about your needs and team up with a proficient accounting service

- Do your research and choose a reputable offshore accounting firm with a strong track record and experience

- Hire one who clearly understands your goals

- A clear understanding of deliverables, schedules, and transparent communication is fundamental to a successful offshore operation

- Establish effective communication channels, protocols, and points of contact for accurate and timely delivery

Offshore accountants familiar with the accounting standards and tax regulations of the countries you operate in can perform tasks beyond recordkeeping, such as preparing financial statements and handling tax preparation. They also ensure compliance with local regulations.

Want an offshore accounting service partner who delivers effectively and consistently? Think Centelli! We’re a UK-based FAO Services provider with global delivery centers in India, providing beespoke services to business of all sizes. Explore our accounting services portfolio and book your free consultation now!

How to Evaluate Offshore Accounting Service Provider

Consider the following steps to ascertain whether the offshore accounting services provider aligns with your CPA firm’s goals:

- Budget: Consider the complexity of the process and the skill requirements to arrive at a ballpark budget. A CPA firm may choose to outsource either its entire client accounting or a portion thereof.

- Assessment: Identify accounting functions suitable for viable outsourcing to an offshore partner. Based on your needs and goals, evaluate these tasks.

- Research: Thoroughly research potential offshore accounting service companies. Verify their reputation, capabilities, and work culture. Also, find out whether they offer tailored solutions.

- Execution: Gain a comprehensive understanding of all aspects of the outsourced offshore accounting model in advance. Both parties should engage in clear discussions and reach a consensus on terms of service, pricing, and communication channels.

Keep these points in mind when evaluating your future service provider to help you decide whether to hire them.

Final Thoughts

An offshore unit am can save you a lot of money. However, the outsourcing-offshoring model can be even more cost-effective for CPA firms wanting to streamline their client accounting operations.

It also enables them to drive productivity and scale quickly without diluting their service quality.

You May Also Like: The Need of Outsourced Bookkeeping Companies for CPA Firms

A competent and reputable offhore accounting service provider can be a valuable asset for your CPA firm. Dilligent research while selecting a partner is key.