- Bookkeeping Services

- Written By Namita Bhagat

The Need of Outsourced Bookkeeping Companies for CPA Firms

24-Apr-2023 . 6 min read

It won’t be surprising if you’re a CPA firm owner weary from spending your precious resources on bookkeeping. So, let’s find out how outsourced bookkeeping companies can come to your aid.

Bookkeeping—a mainstay of accounting—can be tedious and time-consuming for any business. But the process becomes much more complex for a CPA firm.

Because you typically handle accounting for several clients at once!

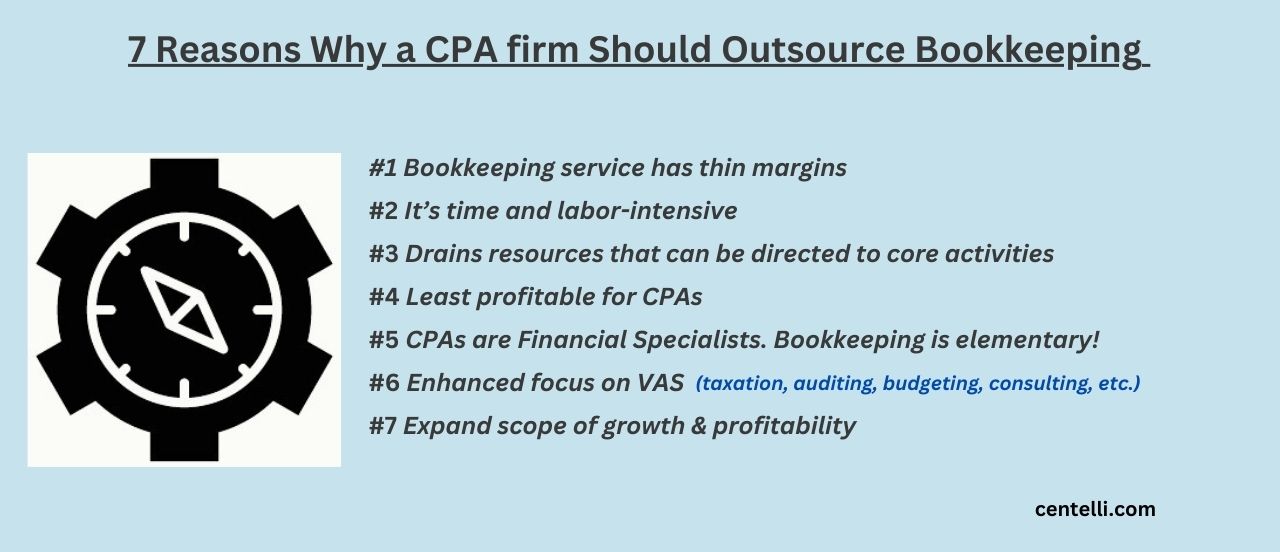

Why CPAs Should Delegate Their Bookkeeping to Outsourced Service Companies

Every CPA firm aspires to have a large client base. But you also need to have the capacity and bandwidth to handle it. It’s a no brainer that insufficient resources can ruin both service delivery and quality.

And it’ can be far more precarious if you’ve a diverse range of clients with complex financial needs.

Below are some reasons why CPAs should assign client bookkeeping to expert outsourced bookkeeping team

Role of CPA and Bookkeeper Not Same

Bookkeepers, accountants, and CPAs are all vital components of a finance operation. But the role and levels of expertise of a bookkeeper and a CPA are vastly distinct.

CPAs are licensed accounting professionals. Of course, they’re well-versed in bookkeeping.

But they work at the top end of the finance and accounting ecosystem. Their role spans more complex areas including advising, auditing, budgeting, tax preparation, etc.

At the far end, the bookkeeper primarily records and maintains a business’s financial transactions. It’s a much basic and simpler role as compared to a CPA.

A good outsourced bookkeeping team can deliver the same results at a much lower cost compared to an in-house resource.

Bookkeeping as Service is Less Profitable for CPA

People perceive bookkeeping as a low-value-adding service. And the fees are typically low. So, bookkeeping services aren’t multi-baggers for a CPA firm.

However, in all fairness, this isn’t about money and profits alone. You don’t need to apply the CPA-level of skills and knowledge for bookkeeping. A trained bookkeeper would suffice.

CPAs should indeed offer value-added services to make the most of their expertise and training.

Bookkeeping Can be a Burden on CPA’s Resources

Bookkeeping works on tiny margins. But it demands a lot of time, labor, and attention. It’s not uncommon to see many CPA firms and their in-house teams struggling.

Despite your best efforts to keep the show running, you may eventually encounter a deadlock — as the mundane, repetitive, and low-margin bookkeeping tasks can hinder your CPA firm’s earnings and profitability.

Monotonous, repetitive recordkeeping can take precious hours and focus away from core activities. In such a scenario, outsourced bookkeeping companies offer a great solution and value.

Evidently, bookkeeping outsourcing services are gaining acceptance and popularity among CPA firms.

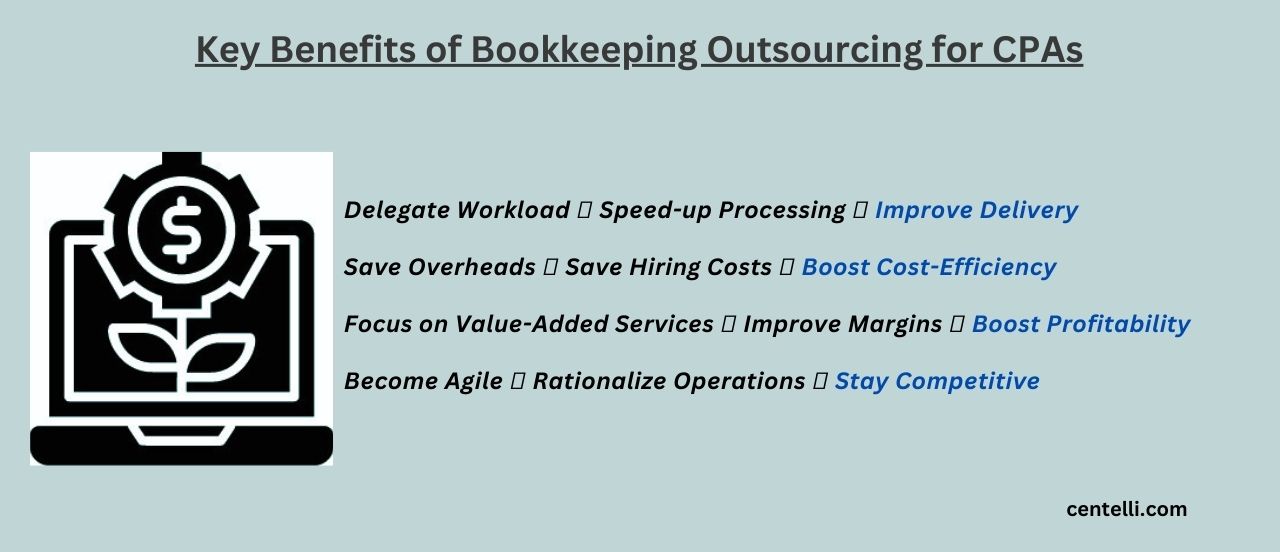

How Can Your CPA Firm Benefit from Outsourced Bookkeeping Companies?

Reasons may not be enough to drive your business decision. Knowing the benefits is absolutely important. Right?

Here are some benefits of outsourcing your recordkeeping and bookkeeping processes if you are a CPA firm:

Outsourcing Simplifies Your Client Bookkeeping Tasks

Outsourcing to an expert bookkeeping service provider helps CPA firms optimize their workflows.

You might need in-house accountants for more strategic tasks. Stuck in mundane bookkeeping tasks, they may not be productive or focused enough.

But the work flows much faster when you get support from outsourced bookkeepers.

Your in-house staff can readily access accurate, organized, and updated financial records prepared by the outsourced team. It allows them to move quickly to the next steps, with enhanced speed and efficiency.

Drive Economies of Scale Via CPA Bookkeeping Outsourcing

Competition in the accounting industry is intensifying. The existing accounting firms and CPA practices are vying for a larger share.

The competition continues to heat up with the arrival of new entrants and trends. It can be difficult especially for smaller firms to survive and grow.

And then, there’s another side to this: the ‘great accounting crunch’. Many accounting and CPA firms (size regardless) are facing it.

But you can tackle this issue by outsourcing to a capable accounting services company. It provides instant access to expert bookkeepers at a fractional cost. So, you can avoid expenses on hiring and training.

Also, you can amplify or downsize the outsourced bookkeeping team as per your needs. So, economies of scale can be a critical driver for a CPA firm’s growth!

Outsourcing enables CPA firms to broaden the scope of their services and add new clients. As such, small firms can climb up the ladder, while big shots can speed up their expansion and growth.

Access Cutting-Edge Bookkeeping Tools

An expert outsourced bookkeeping solutions company won’t lag in technology either. They deploy market-topping accounting software to manage clients’ accounts for CPA firms. By leveraging advanced bookkeeping tools, they can ensure that your books are accurate and delivered on time.

Leverage Bookkeeping Automation

Automation is transforming accounting and bookkeeping in many ways.

Automated processes not only help reduce errors, but also save money and time. Which also enables real-time data access and transfer.

A bookkeeping service can automate its workflows with feature-rich software, tools, and specific routines.

Notably, bookkeeping automation can improve workflow and turnaround, but it still requires human oversight.

So, make sure your service provider has the right automated systems and trained bookkeepers in place.

Ensure Data Security with Savvy Outsourced Bookkeeping Firm

Accounting firms are custodians of their clients’ confidential financial data and information. Therefore, data security is a top priority for reputable CPAs and outsourced bookkeeping companies alike.

Furthermore, professional bookkeeping services adhere to robust security standards throughout the process. In addition, constant monitoring helps mitigate the risk of data breaches.

Use CPA Outsourcing Services for Managing Large Workloads

Tax season is the busiest time for CPA firms. With no scope for tax preparation and filing errors and delays, you might find yourself time-pressed and chasing deadlines. Things can often become chaotic as a result.

Moreover, chaos can turn into trouble in the absence of accurate data and up-to-date books.

Here, CPA outsourcing services help you avoid stressful times by having outsourced bookkeepers perform recordkeeping without exhausting your in-house team.

Additionally, you can also get support for extended workloads during events like tax season. Remember, the outsourcing model allows for an agile and quickly scalable bookkeeping processes!

Outsourced Bookkeeping Can Help Expand Scope of CPA Services; Boost Growth

An accounting or CPA firm may find itself trapped in the low-value services muddle. As mentioned earlier, bookkeeping tasks are time and labor-intensive, consuming a significant amount of time and leaving little room for core initiatives.

Consequently, you may not be able to expand your service offerings or take on more profitable opportunities and new clients. Outsourcing your bookkeeping, however, sets you free to focus on higher-value offerings and strategic initiatives!

Looking for a reliable outsourced services that can effectively handle your CPA firm’s bookkeeping workloads ? Centelli can be your ideal partner! Book your free consultation to explore how our CPA-focussed solutions can benefit you!

Conclusion: CPA Bookkeeping Support Services

In today’s hyper-competitive CPA services landscape, the real money lies in value-added services. Bookkeeping can be the least lucrative undertaking for a CPA firm. As such, contracting with outsourced bookkeeping companies has become common practice among CPA firms.

Read More: Outsourced Accounting: 3 Ultimate Reasons Why It’s Apt for CPAs?

Significantly, payroll, tax preparation, and virtual CFO services are also highly sought-after by many accounting firms.

Outsourcing your CPA firm’s bookkeeping needs frees up time and resources, enabling a focus on high-value services like taxation, auditing, and consulting. Which, in turn, helps you seize more profitable opportunities and scale up