- Accounting Services

- Written By Namita Bhagat

The Top Benefits of Finance and Accounting Outsourcing to India

28-Sep-2023 . 8 min read

Finance and accounting outsourcing (FAO) services are a significant part of India’s outsourcing industry.

The multinational firms began contracting out back-office tasks to India in the 1990s. Over time, India has become a premier global outsourcing destination. The service spectrum ranges from data entry, customer support, IT, HR, legal, financial services, and more.

Companies from across the world are drawing on local expertise, bolstering operations back home.

In this article, we’ll overview the advantages of finance & accounting outsourcing. Also, discussed in detail are the top benefits and key considerations of outsourcing to India.

Why Outsource Finance and Accounting?

In the era of globalisation, economies and businesses are becoming increasingly inter-connected. Digitalization has also made world-wide collaborations so much easier!

Globalization and digitalization have given a lot of push to the FAO phenomenon as well. But there’s this myth that only big business can or should outsource offshore. On the contrary, it can be an excellent strategy also for small and medium sized firms.

How?

Building and maintaining an in-house finance and accounting department requires considerable infrastructure, personnel, and budget. While large businesses can afford this, it can be an expensive proposition for smaller businesses.

By outsourcing, you can skip both upfront investment and operating costs. Furthermore, you can save even more with overseas outsourcing because you gain a labor cost advantage!

India, an Ideal Destination for Finance and Accounting Outsourcing (FAO)

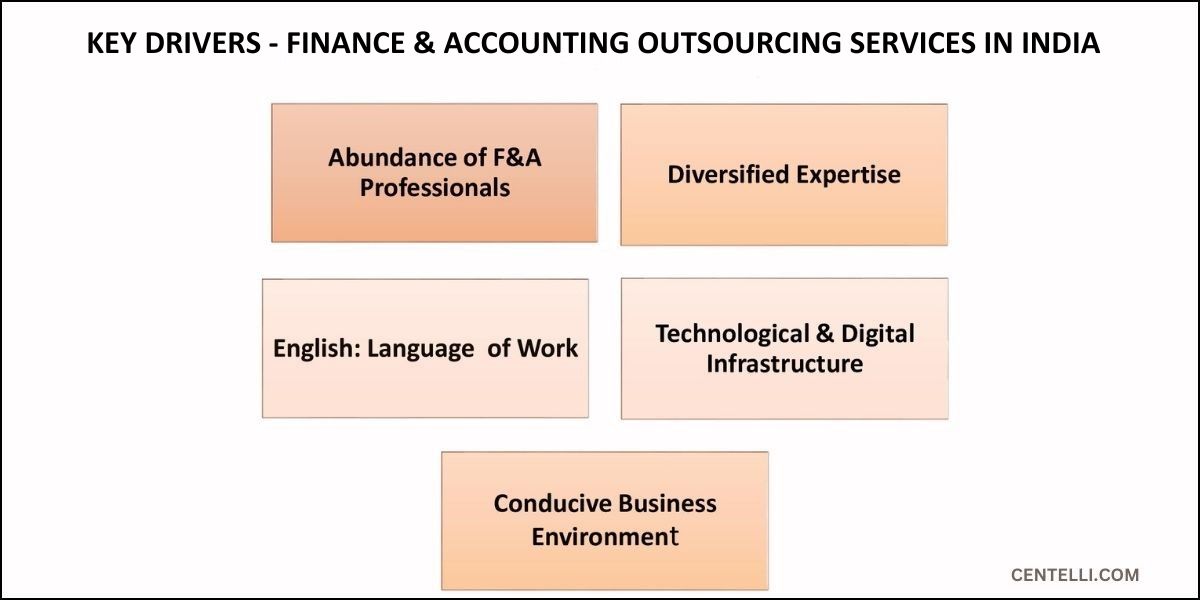

India has a strong track record of delivering high-quality FAO services to global clients. It’s known to be the most preferred FAO destination, thanks to a combination of factors.

The country has abundance of English speaking, skilled workforce. It also offers low labor costs. Efficiency and productivity are two other major leverages you cannot ignore.

Let’s take a closer look at these factors:

1. Large Pool of Finance Professionals

People in India are quite inclined towards business studies, commerce, finance, and accountancy fields. Numerous students enroll for vocational, undergrad and post-grad courses in these streams every year. Different courses offer different skills and different levels of expertise and specialization.

Here’re some statistics (Source: The Institute of Chartered Accountants of India or ICAI) to give you just an idea of the number of charted accountants (CA) alone.

By the end of August 2023, there were 3,95, 949 active members while the number of active students enrolled for CA courses had reached 8,34,578.

Markedly, ICAI is a government-administered statutory body responsible for regulating the Chartered Accountancy profession in India. It’s also the world’s second biggest professional body of CAs.

Finance and accounting professionals in India who work with global clients are well-versed in international accounting standards.

The FAO services catering to international clients hire staff skilled in GAAP and IFRS . However, the range of services offered may vary.

Some providers offer end-to-end finance and accounting services, including bookkeeping, accounting, accounts payable/receivable, payroll processing, tax preparation, and financial analysis. Many also provide highly specialized services such as advisory and audit.

Interestingly, there’s also a growing interest for Certified Public Accountant (CPA) accreditation. US CPA is globally recognized and one of the most sought-after finance and accounting certifications conferred by the American Institute of Certified Public Accounts (AICPA).

2. English Language Skills

Significant populace of India’s can understand and speak English. They surely have working knowledge of the language at least. That’s because the professional education delivery is in English.

So, the top company officials, departmental heads, and managers are fluent. Even though an entry-level employee may not have strong English skills, they’ve satisfactory working knowledge. This makes easy for businesses to communicate and collaborate with their outsourced finance and accounting teams in India.

Importantly, there’s a large Indian diaspora abroad. An increasing number of people travel overseas for work or leisure.

The FAO services in India are adaptable to global work culture. That helps minimize friction and build a seamless communication and workflow. Some cultural adjustments may be needed, nevertheless.

3. Cost-Savings and Time Zone Advantage

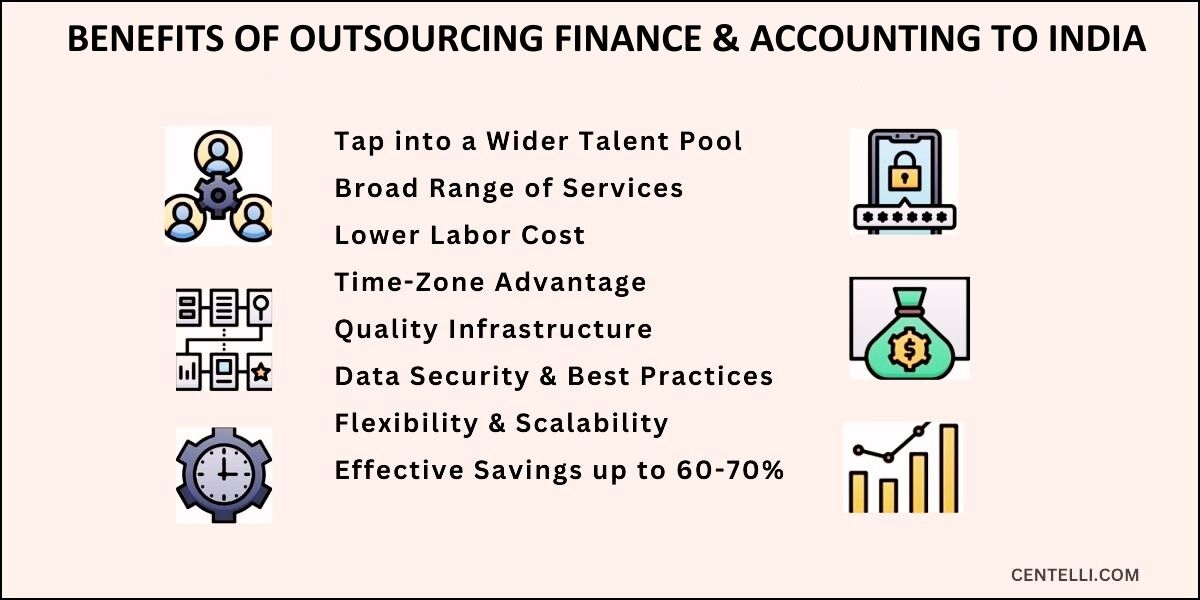

Notably, labor costs are a major expense for most businesses. You can save up to 60-70% of the total operating costs by outsourcing to India.

In contrast to developed nations like US, UK, Australia, etc., the cost of labor in India is significantly low. Their currencies are also higher-valued than India’s. You straight up benefit on these two counts. So, it’s rather affordable to outsource finance and accounting operations to the country.

So, you can not only save massively but are free to use those monetary resources on other critical processes and projects.

Furthermore, the different time zones can also be a great advantage when you’ve an appropriate process and schedule worked out with your FAO service provider.

For instance, London is about 4.30 hours behind New Delhi while Sydney is 4.30 hours ahead. Businesses in UK and Australia can find a convenient overlap with their outsourced teams in India. This also allows for real-time communication and exchange.

Then New York is 9 hours behind India, which means US businesses will get delivery effectively on the same day. Notably, many FAO firms provide 24/7 services.

FAO Services and India’s Business & Technological Environment

Offshoring your finance and accounting isn’t an easy decision. But if you’re concerned about the infrastructure and business environment in India, there’s nothing much to worry.

India is among the most preferred offshore and outsourcing destinations. Its fame can be majorly attributed to its favorable regulatory and business milieu.

Outsourcing has now matured into a vibrant industry with thriving BPO hubs. They are spread across Bengaluru, Hyderabad, Chennai, Pune, Delhi-NCR, and Chandigarh-Mohali-Panchkula (the tri-city), etc.

These hubs boast of avant-garde internet, communication, technological, and digital infrastructure.

A growing number of businesses from abroad are now leveraging FAO services. There’s an ample supply of tech-savvy finance and accounting professionals and specialists working with FAO companies. They’re well-versed in leading financial/accounting software and platforms.

It’s worth mentioning that reputable FAO service providers are also gung-ho about cyber and data security. They ensure a robust IT infrastructure and adherence to safety protocols.

You May Also Like: Accounting Outsourcing vs Offshoring – How the Two Strategies Stack Up!

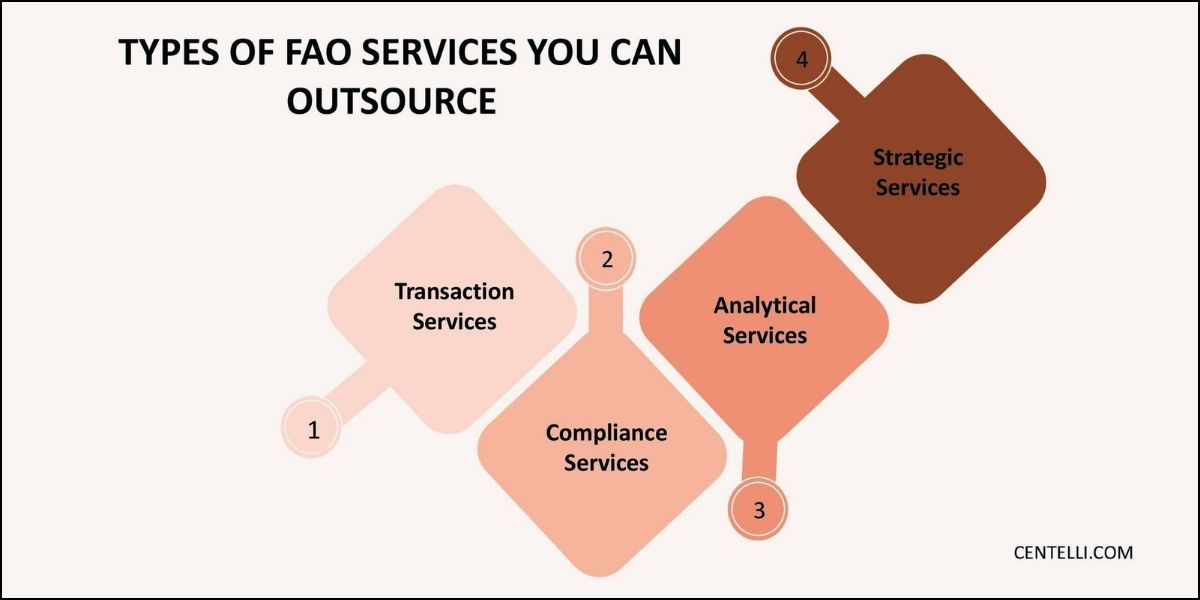

The Types of Finance and Accounting Outsourcing Services Offered in India

There are mainly four categories of finance and accounting services that you can avail: Transactional, Analytical, Compliance, and Strategic. Let’s delve into each of these a bit more!

1. Transcation Services

The FAO service partner takes care of your everyday financial and accounting processes. These could be bookkeeping, invoice processing, billing receipts, bank reconciliations, accounts payable and receivable, payroll, and financial reporting.

2. Analytical Services

Your service partner is entrusted with financial data analysis and reporting. The analysis and reports provide you with a detailed overview of your business’s performance. You can use the findings to identify the scope for improvement as well as growth. For instance, analytical FAO services may include budget preparation, trend analysis, and forecasting.

3. Compliance Services

Financial and tax regulations are complex and constantly changing. An up-to-date FAO service uses best practices to ensure your business remains compliant. Tax preparation and filing, audits, and reviews, are some key services that fall under this category.

4. Strategic Services

If you’re planning restructuring, merger & acquisition (M&A), fund-raising or going public, you’ll need specialist services. You can sign up with strategic FAO services that offer consulting for such matters.

Things to Consider When Outsourcing Finance and Accounting Operations to India

Research is the key to finding suitable finance and accounting outsourcing services. Look for a service provider with expertise, experience, and a strong reputation.

Here’ how you can do that:

- Get a sense of service provider’s standing. Go through online reviews and ask for references from fellows and previous clients to learn more about them.

- Financial processes and accounting regulations, approach, and needs vary from industry to industry. Ensure that the FAO services you tie-up with has served businesses like yours.

- Clear and timely communication is imperative to a healthy client-service relation. You should discuss your needs and any specific requirement before. Both parties should agree upon and establish feasible communication modes.

- Mutual clarity and understanding of expectations and deliverables are critical. It’s better to mention all deliverables, terms, and conditions in the contract prior to signing. This can ensure your peace of mind but also a fruitful collaboration.

- Set up a quality control process to make sure deliveries are on time and error-free. Reviews, checks and timely feedback will ensure the outsourced team stays on track.

- Regular monitoring and communication can help you ensure output is in sync with goals. It will also allow for any alignments and adjustments if needed.

Are you a business a CPA/Accounting firm looking for a reliable finance and accounting services partner? We’re a UK-headquartered FAO services company with delivery centers in India and a global reach, helping you save up to 60% in costs compared to in-house. Get in touch with us today!

In Summary

India can be an excellent option destination for businesses looking to offshore finance and accounting outsourcing. It has a large pool of skilled F&A professionals knowledgeable about global accounting standards and regulations.

You May Also Like: 9 Most Outsourced Finance and Accounting Services [Explainer + Tips]

The FAO companies here offer a wide range of services at competitive labor costs. As such, business of all sizes may outsource to India. Nevertheless, while outsourcing, a business should carefully evaluate its needs. And choose a service provider that can meet those needs.