- Accounting Services

- Written By Namita Bhagat

Accounting Outsourcing vs Offshoring – How the Two Strategies Stack Up!

10-Oct-2023 . 8 min read

Accounting isn’t a core function for most businesses. Yet, a substantial chunk of their resources and time gets expended on in-house operations. “Offshoring” and “Outsourcing” are two savvy ways to conserving precious resources that could be allocated to core activities. Interestingly, accounting outsourcing vs offshoring is a also passionately debated topic.

In this blog post, we’ll take stock of both approaches and find out how they stack up. And we hope you’ll gain important insights to help you decide which strategy is better for your business and why.

Offshoring and Outsourcing: Two Different Routes to Accounting

No doubt, businesses need to rationalize their processes and cut down the unnecessaries. You can reduce the costs and burdens of accounting through offshoring and outsourcing. But before we get into the offshoring vs outsourcing debate, let’s look at some key differences you need to be mindful of while choosing your course.

What is Offshore Accounting?

Notably, a company may do offshore manufacturing, software development, customer service, or finance and accounting. Please note that we’re referring to “captive offshoring” here.

[Captive] offshore accounting entails creating your [own] division in a foreign land. The labor costs are considerably less in emerging nations, but they are talent and skill-rich nonetheless. Therefore, it can be economically more sensible to relocate your accounting department to such a location with a captive unit.

What is Outsourced Accounting?

When you contract an external firm or individual to handle your end-to-end accounting function or part of it, you enter the outsourcing realm. You can tie up with a service provider from anywhere. It may be located near you – same city, same country. Or far away in some other country.

However, when you outsource accounting from overseas, it’s called offshore outsourcing. We’ll explore this concept at length in forthcoming sections of this article.

Furthermore, “nearshoring” is yet another concept. A business may prefer setting up its captive operation or appointing an outsourcing partner in a nearby country closer to home. So, in both cases, you’re relocating your accounting process nearby.

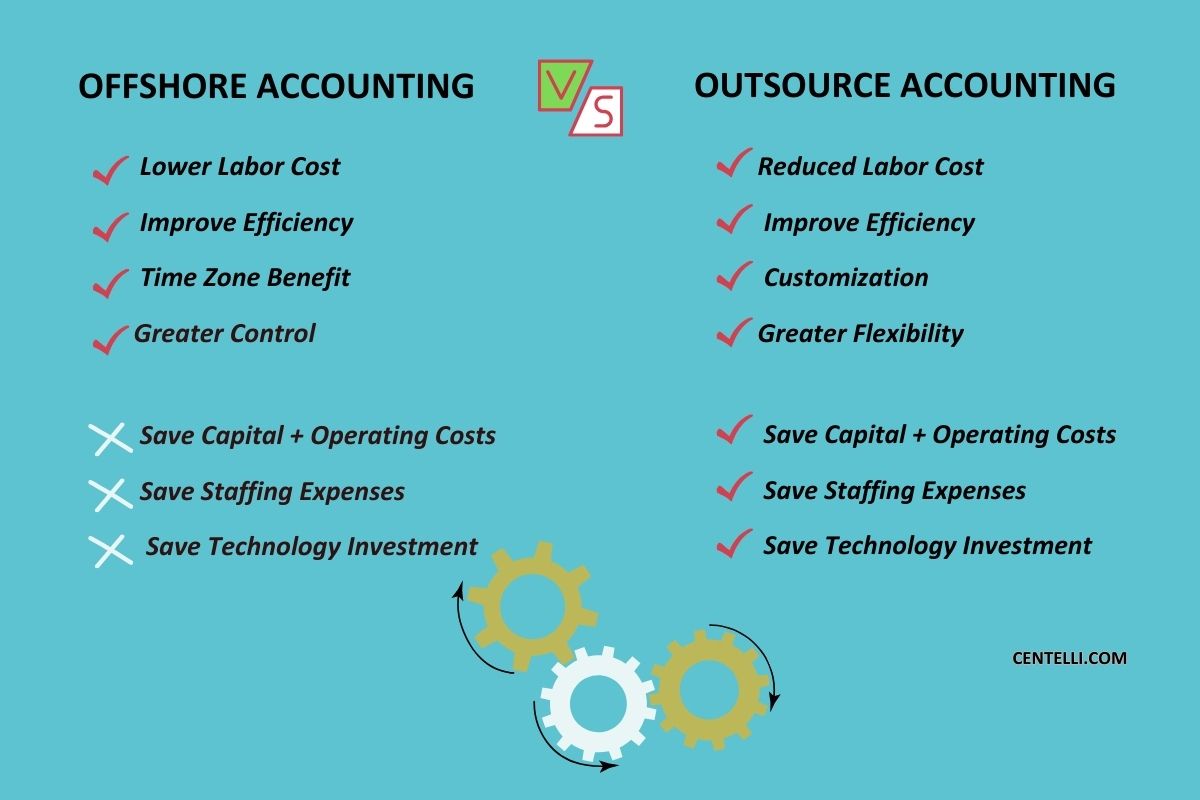

Top 5 Benefits of Offshore Accounting

As aforementioned, captive offshoring can be a viable means for businesses to rein in their accounting operations expenses. Let’s dive into various key advantages you can expect from offshore accounting:

- Lower Labor Costs: Wages and hiring costs in developed countries are typically higher than in developing nations. So, you’re in for huge savings through offshore accounting.

- Diversified Expertise: You can enrich your in-house talent pool with skilled accountants experienced in different industries and settings.

- Time Zone Advantage: You can build a round-the-clock operation with an offshore accountants’ team working in a different time zone. It’s especially beneficial if you’re a business with global operations.

- Greater Process Control: From execution to management, everything is in-house. Thus, you’re in total control of your offshore accounting operation.

- Reduced Data Risk: Since the data stays in-house, you can be surer about its safety.

Top 5 Benefits of Accounting Outsourcing

Want expert accountants and bookkeepers without spending heavily? If yes, go for accounting outsourcing to reap these benefits:

- Access Expertise & Specialized Skills: Outsourced accounting services can provide businesses with access to accounting expertise and specialized skills you may not have in-house.

- Save Business Expenses: Staff salaries, benefits, and other overhead costs make for a significant portion of business expenses. By outsourcing accounting tasks, you can save it all, plus hiring and training costs. It saves you on technology expenditure, too.

- Improve Productivity & Turnaround: Whether you outsource the entire accounting process or some tasks, extra hands can help streamline the overall function. So, you get improved productivity and turnaround time. Service providers catering to global clients may also offer 24/7 support.

- Focus on Core Business Processes: When you outsource accounting work, you can focus on core processes and grow your business.

- Flexibility: Companies grow. Their accounting needs may also grow. You can sign up for an outsourcing partner that offers customized services to align with your varying needs.

Offshoring vs Outsourcing – The Better Accounting Operations Model?

Which model is the best fit for your business will depend on your specific needs and requirements. However, there’re a few questions you need to ask yourself!

Do you have enough funds to raise your captive offshore unit? Is cost reduction your primary motive, but control dilution frets you? Offshore accounting can be a good option for you in that case.

Cost savings, budget constraints, or simply saving yourself from the hassle of running an in-house process! If any of these reasons resonate with you, outsourced accounting is more suitable for you.

Remember, it’s important to carefully evaluate your needs and requirements before choosing any of the discussed accounting strategies. You should explore multiple offshore destinations or research different accounting outsourcing service firms as required.

Optimizing Accounting Operations via Offshore Outsourcing

Let’s talk first about some challenges of the above-mentioned models!

While captive offshoring gives you more control over the accounting process, it can be a little expensive and complex. Despite labor cost advantage, upfront investment and ongoing operating costs can be dampeners.

Moreover, your internal resources may get trapped in mundane, low-value accounting and bookkeeping tasks, which can sidetrack more valuable activities.

In contrast, outsourcing saves you the investment and overheads of running your [own] accounting division, but the process is no longer under your tight control. Thus, you need to trust your service partner because you won’t be able to keep a tab on every minute activity at their end.

Outsourcing vs offshoring talk is here to stay. However, you can look at another option as well, which is a blend of these two models. The “Offshore-Outsource” approach provides businesses with a potent solution to optimize accounting operations much more effectively.

Markedly, countries like China, the Philippines, Vietnam, Mexico, and India are the foremost global offshore destinations. They attract businesses from across the world looking to outsource their accounting tasks.

If you’re searching for expert accounting outsourcing services partner, think Centelli. Explore Our Full-Suite Finance and Accounting Services! We can help your business optimize operating efficiencies via our offshore delivery centers in India serving our clients worldwide. Leave us a message here to book a free consultation.

The Collective Benefits of Offshoring-Outsourcing Strategy

Below are some points to help you understand how a hybrid strategy of outsourcing your accounting operations offshore can be more beneficial:

- Maximized Cost-Efficiency: Offshore outsourcing ensures labor cost advantage and infrastructure investment and operating expenses savings. No need to spend on staff hiring as well. Also, you can bring more efficiency by partnering with an accounting service operating 24/7.

- Variegated Expertise & Know-How: A reputable offshore accounting outsourcing services provider maintains a highly professional team. The bookkeepers and accountants are well-versed in GAAP and compliance norms. Besides, you also get access to their advanced technological infrastructure and accounting software.

- Greater Flexibility & Scalability: Flexibility is an attractive feature of outsourcing. Whether expertise, range and scale of services, or payment models, you can shift gears quickly as per your need even when you outsource offshore. It can be difficult, however, when you’ve a captive offshore operation.

- Free up Resources, Better Time Management: Focus on core activities levels up as you cut back on resources, time and labor used up in accounting and bookkeeping work. It also opens up doors for business expansion and profitability.

- Exposure to New Market: When you outsource offshore, it’s not just an expense. It also widens your horizons. You gain exposure and understanding of local expertise, work culture, labor market, business environment, laws and regulations. Moreover, it can help you a lot if you ever decide to expand your business in that country.

You may also like : The Top Benefits of Finance and Accounting Outsourcing to India

Closing Note

Accounting offshoring vs outsourcing – the debate is natural because every business decision has a long-term impact. However, it’s essential to understand that both captive offshore operations and outsourced processes have unique benefits and limitations.

On the other hand, the hybrid approach of offshore outsourcing offers the best of both worlds and helps tackle limitations posed by the two models individually.

Overall, outsourced offshore accounting can be a good option for businesses looking to streamline their accounting processes and enhance productivity cost-effectively.