- Accounting Services

- Written By Namita Bhagat

9 Most Outsourced Finance and Accounting Services [Explainer + Tips]

16-Oct-2023 . 6 min read

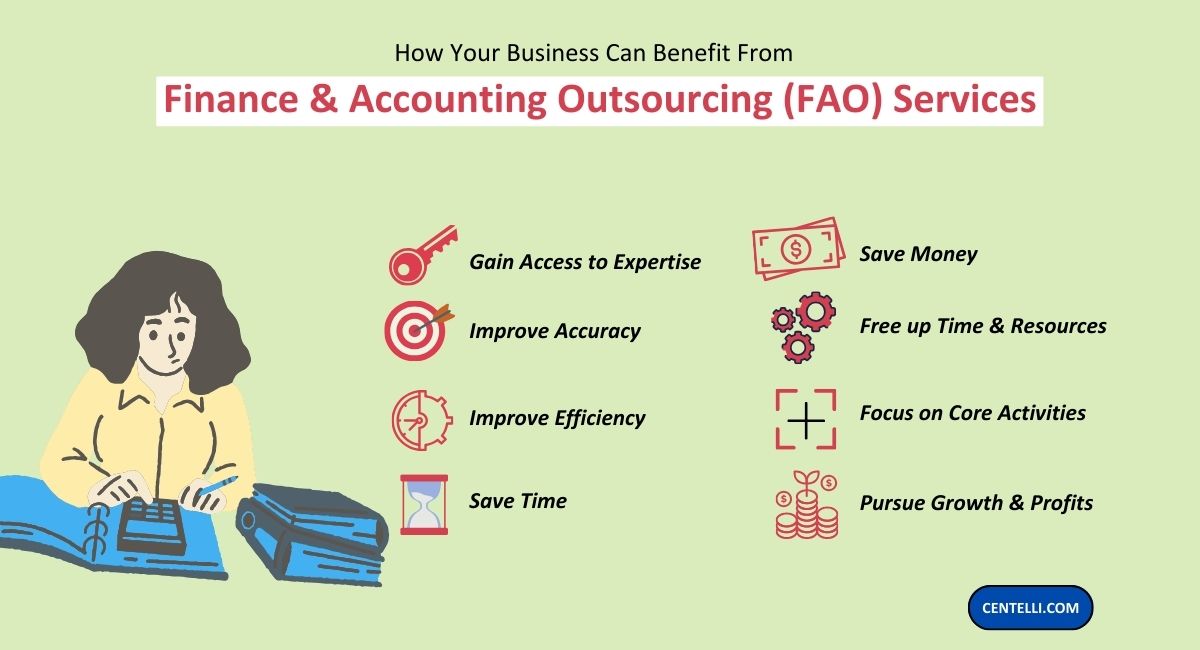

A business needs to operate in the most thoughtful ways to survive and grow. Therefore, many businesses now leverage outsourced finance and accounting services to free up their in-house resources for core activities.

The best part is that this also helps them save significantly on operatinal expenses!

So, if you are also considering taking this path and need a quick rundown of some popular finance and accounting outsourcing (FAO) services that businesses typically sign up for, read on…

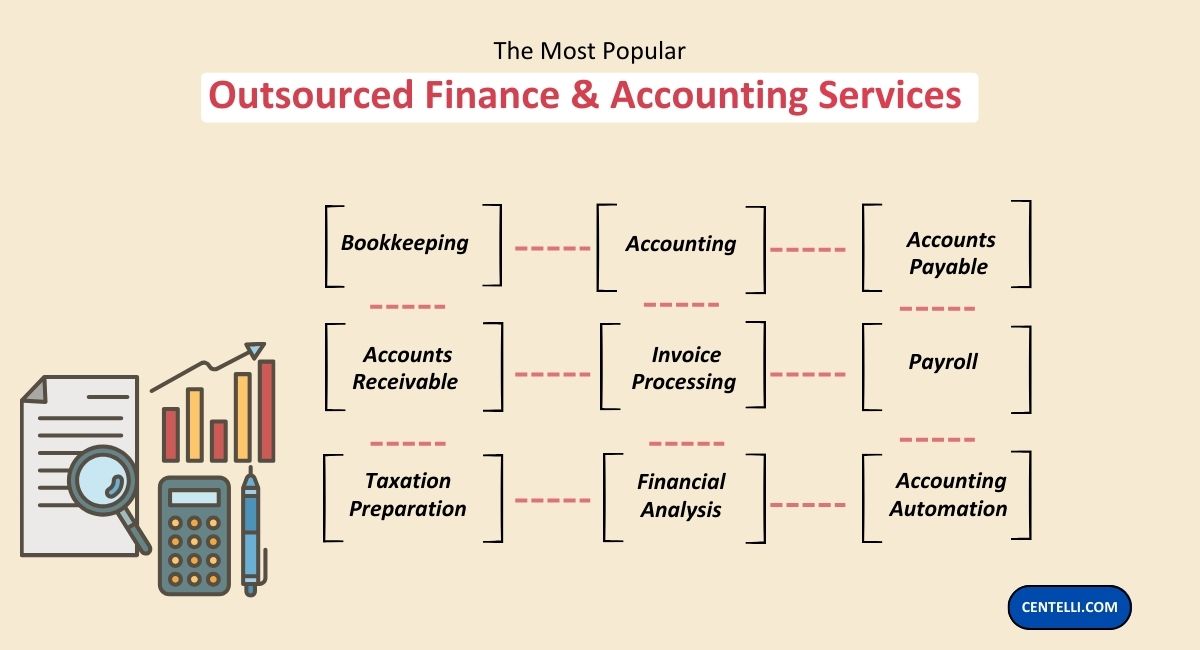

9 Most Outsourced Finance and Accounting Services Your Business Can Also Leverage

When priorities are clear and you’re focused on your core business activities, you can work towards stability, success and growth. And you can make room for this by outsourcing non-core activities with external service providers.

Please find below the most widely used FAO services that businesses commonly outsource to streamline their operations:

#1 Data Entry and Bookkeeping

Proper bookkeeping is provides a strong foundation for effective financial management. It involves recording, organizing and updating the data of all your business’s financial transactions, such as sales, purchases, and expenses.

Source: finance.yahoo.com

But these multi-step data entry and data storage tasks are time-consuming and laborious. Especially when the bookkeeper is amateur, or business has a lot of transactions. A bookkeeping specialist company can ensure your books are accurate and well-organized at all times.

#2 Financial Accounting Solutions

A proficient accounting services can help you maintain accurate and systmatic financial records. It can be many different records, such as ledgers, cash payments and receipts, accounts payable, accounts receivable, and payroll.

Error-free books of accounts are essential for creating financial statements such as the balance sheet, income statement, and cash flows. These statements capture a snapshot of your company’s financial flows.

They also provide detailed reports and analysis, showing how well your business is performing financially and enabling you to plan accordingly.

#3 Accounts Receivable Outsourcing

Accounts receivable (AR) is the process of managing incoming payments from customers. This can include tasks such as collecting payments and following up with customers, preparing and sending account statements, reconciling invoices, and processing credit memos to name a few.

AR processing can be challenging when you’ve a lot of customers or you need to track large volumes of receivables. This also means you need more manpower to manage it all, which can be costly if handled in-house.

Hiring an expert accounting receivable service partner to manage your billing/invoicing and payment collections helps optimize your cash flow and reduce the risk of unpaid invoices.

#4 Accounts Payable Services

Accounts payable (AP) is the process of managing outgoing payments to suppliers and vendors. It may include tasks such as managing invoices, processing purchase orders and debit memos, managing AP ledgers, and managing utility bills.

However, the process can take a lot of time and the chances of errors shore up when you deal with multiple suppliers.

Lack of efficiency and late payments can strain your supplier and vendor relationships! But you can achieve a seamless process by outsourcing it to a skillful accounts payable service.

#5 Invoice Processing Services

Invoices are proof of a sale or a purchase. As a business, you buy and sell things. Therefore, seamless invoice processing is imperative to keep track of your expenses on purchases and raise payments from customers.

You can make sure that invoices are accurate and processed on time by outsourcing invoice processing to an expert service. They can help you with tasks like transaction logs, invoice matching, handling check and cash, and so much more.

#6 Outsource Payroll Tasks

Payroll processing means calculating and paying employee salaries and wages. It includes tasks such as calculating applicable deductions, taxes, and benefits. The payroll cycle is different for every business, however – it can be on a weekly, bi-weekly, or monthly basis.

Outsourcing serves as an effective tool to make business operations and workflows more efficient, improving productivity and ROI. Because of these clear benefits, the finance and accounting outsourcing (FAO) phenomenon is evidently surging!

The function can be difficult and time-intensive for several reasons. But it is easy when you outsource with a skilled service provider.

#7 Outsourced Tax Return & Filing

Tax preparation and filing can be complex as well as tedious. Any significant unintentional error or lapse can get your company into trouble with the law. You may also lose out on certain deductions and tax management opportunities when your businesses taxes aren’t handled by a tax expert.

Handing over your tax preparation to a professional tax service would be a practical and prudent decision, wouldn’t it? You can also enjoy peace of mind knowing that an expert outsourced tax services provider is at work.

#8 Financial Analysis Outsourcing

You can evaluate your business’s financial performance by analyzing different ratios (profitability, activity, liquidity, etc.,), benchmarks and trends. Financial analysis of data in financial statements helps you to identify areas where you’re strong and where you need to improve.

Financial analysis outsourcing services can bring in the necessary knowledge and skills for a precise and objective assessment of your business. So, you can plan the next steps with confidence.

Furthermore, the extended services may also include financial reporting and a virtual CFO for improved financial management.

#9 Accounting Automation Services

You can harness the power of automation to improve the effectiveness of your financial processes. Outsourced accounting automation services can help you automate a range of processes, including bookkeeping, payroll, record-to-report, order-to-cash, procure-to-pay, and more.

Automation can not only speed up processes but also eliminate errors to almost zero. However, it’s important to note that automation is not meant to replace human workers entirely but aid them.

Generally, accounting automation outsourcing services can be cheaper than doing it in-house.

Things to Keep in Mind While Scouting for Finance & Accounting Outsourcing Partner

- You can outsource your finance and accounting function from start to finish, or just a few processes. Notably, the latter option is especially useful if you’ve budget constraints but want to leverage outsourcing to your advantage.

- Prior to outsourcing any financial function or process, you should assess its role in your business operations. Obviously, you may not delegate tasks which are closely associated with your core business activities.

- Make sure you partner with a FAO service provider that is qualified and trustworthy. Look for someone who can meet your specific needs if you’ve any. This will help you maximize your outsourcing benefits.

If you’re looking to outsource your accounting or other financial processes, consider us. We offer tailored and scalable services to businesses of all sizes. Check out our offerings and book your free (no strings attached) consultation today. Leave us a message here.

Closing Note on the Growing Popularity of Finance & Accounting Outsourcing Services

Signing up with outsourced finance and accounting services can significantly free up your internal resources—people, infrastructure, and finances. This strategic move allows you to focus on your business’s core competencies and maintain competitiveness.

You May Also Like: The Top Benefits of Finance and Accounting Outsourcing to India

Most importantly, these services come in all shapes and sizes: contracted finance and accounting services, remote support, virtual CFO services, cloud-based accounting solutions, and managed accounting services, and so on.

So, whether you’re a startup, an SMB, or a large corporation, outsourcing some or all of your financial functions can benefit your business in so many ways. Have you considered it yet?