- Accounting Services

- Written By Namita Bhagat

Outsourced Accounting: 3 Ultimate Reasons Why It’s Apt for CPAs?

02-Aug-2023 . 5 min read

We all know that CPAs, or Certified Public Accountants, are well-trained accounting professionals. So, why would they need to hire outsourced accounting services is a pertinent question!

Interestingly, the trend is on an uptick—and seems like one of the most striking shifts happening in the realm of CPA practice.

Markedly, surmounting workloads, scant in-house resources, sloppy workflows, and functional inefficiencies are some common pressing problems CPA firms are facing today. And many are finding outsourcing a pragmatic way out!

Why Should CPAs Consider Outsourced Accounting? ( Top 3 Reasons)

So, let’s examine in depth the most critical reasons and triggers that make it super imperative for these finance and accounting specialists to outsource their client accounting tasks.

#1 Tackle Accounting Talent Shortage via Outsourcing Route

Many CPA firms are having trouble recruiting and retaining qualified accounting staff. The talent crisis in the US CPA industry is getting worse, as per reports, for instance.

With delays in project completions and client service going downhill, the prospects of signing in new clients may also turn bleak for some practices.

Seeing this, using a third-party accounting service can be an effective solution to accounting staffing woes. You can leverage the resources of an external partner to uplift your service delivery and meet client expectations when you outsource.

There’re two ways to go about it: delegate your entire accounting department or use selective services to support internal teams. Either way, it allows you (and your in-house team) to concentrate on more valuable tasks and take on high-value clients.

In a nutshell, an external service provider brings in:

- A pool of skilled accountants & specialists

- Know-how of CPA industry standards & regulations

- Accuracy and seamless processes

- Improved productivity & cost efficiency

#2 Accounting Outsourcing Can Help Align with Ever-Evolving Compliance

The finance industry is very significant and complex – and governments like to keep a close eye on its functioning. Reforms and regulatory changes are unleashed from time to time, which keeps CPA practitioners on their toes.

As your practice must abide by all existing laws and regulations, you can entrust your service provider to handle compliance when outsourcing your accounting operations.

With the service provider taking care of the matter, you need not bury yourself in the compliance management process anymore. Abreast of regulatory updates, they can handle the nitty-gritty of compliance requirements effectively.

With the burden off your mind, you can look into other more important aspects of your practice – client handling and client service, for example. Importantly, improved compliance also means a good reputation – so, you can approach your clients more confidently.

In short, accounting and bookeeping outsourcing services can help CPAs boost compliance:

- Reputed service providers are up-to-date with regulatory changes

- Leverage the expertise of compliance specialists

- Leverage the latest compliance management technology

- Get regular compliance management assistance

#3 Leverage Outsourced Accounting to Meet Client Changing Needs

You might have individuals, small businesses, large enterprises, governments or non-profits on your client list but remember their accounting requirements can evolve with time. They might as well seek advisory services at some point.

Consultation for managing financial risk in uncertain times or expansion phase for instance. Besides, the other needs may also increase or decrease over time.

A good CPA should be agile enough to adapt to their client’s needs. But just imagine how cumbersome resource re-allocations and rearrangements can be!

Thankfully, outsourcing allows you to be flexible without disrupting your internal operations. Choose which areas of the internal accounting department you want to delegate and for how long?

This way you’ll not only be able to serve your client better but also improve relationships and consolidate business with them. Of course, one can’t also risk losing clients if they’re valuable.

In brief, a third-party accountants can help CPAs align with clients evolving needs:

- Outsource end-to-end or partly as per project requirements

- Free yourself to provide value-added services to clients

- You can leverage short-term outsourcing for specific projects

- Adapt to client’s shifting needs without in-house disruptions

Outsourced Accounting and Bookkeeping Can Also Support CPAs’ Growth

With the demand for CPA services amplifying, there’s ample scope for growth. However, every CPA practice that wants to scale up would like to use its resources and time wisely to ensure success.

Therefore, a firm undergoing a growth spurt or planning expansion should consider using the services of an accounting outsourcing company to back it up. No more bound by non-core activities, your in-house resources will also be free to assist you.

And you’ll be able to focus entirely on the expansion efforts.

Moreover, your accounting service provider can take in increased workloads as the business expands. There’ll be no need for additional in-house hiring or infrastructure investments at your end as such.

You may also like: The Need of Outsourced Bookkeeping Companies for CPA Firms

Outsourcing Can Elevate Client Experience

Many CPAs choose to outsource their accounting and bookkeeping tasks, primarily to tap into the service provider’s diversified pool of experts and up-to-date infrastructure, which helps improve their productivity and cost-efficiency.

It also enables faster service delivery — a key performance indicator that enables a CPA firm to maintain a competitive edge.

So, you can save time on outsourcable processes and focus more on building and nurturing client relationships. Handling peak seasons efficiently with timely deliveries and accurate financial information will boost your clients’ confidence.

Conclusion

By partnering with an outsourced accounting firm, CPAs can effectively address pressing issues such as talent shortages, compliance updates, and ever-evolving client needs.

Moreover, using cost-effective accounting solutions helps reduce your firm’s overhead. Above all, you can secure peace of mind with a dedicated outsourced team handling your day-to-day tasks with minimal supervision.

Is your CPA firm facing any such challenges or considering outsourcing your accounting tasks anyway? We at Centelli are here to help! You can use our accounting expertise to take your client experience and staisfaction a notch above. Get in touch today!

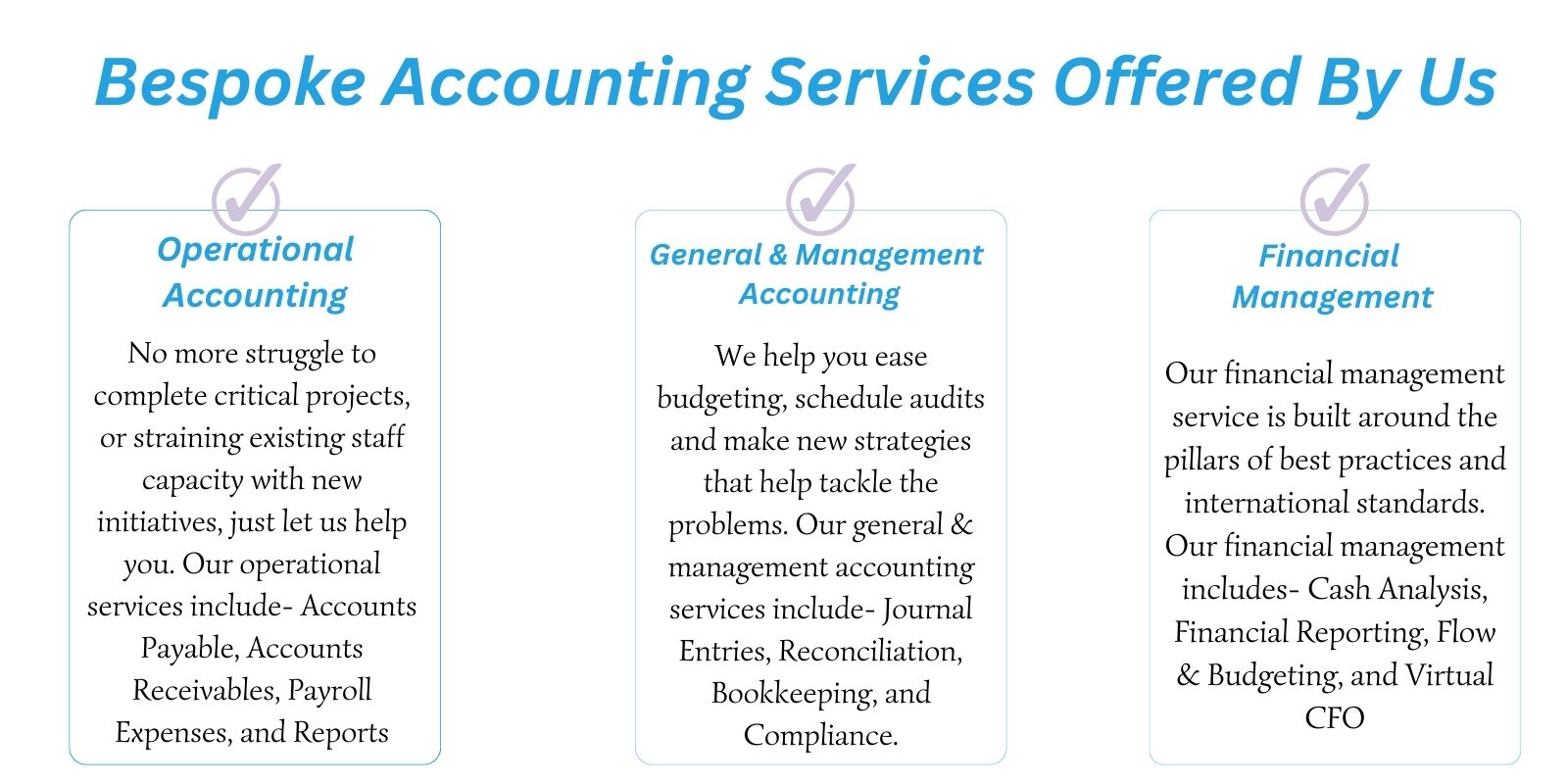

Please visit this page for more details on our bespoke accounting services. Here’s a snapshot: