- Accounts Receivable Services

- Written By Namita Bhagat

What is Accounts Receivable and its Process

03-Mar-2023 . 5 min read

Updated: 21 May, 2024

Let’s take an overview of what accounts receivable are and how you can streamline the process for enhanced performance!

When running a company, you know how crucial money inflows are for maintaining optimal operations. And without proper accounts receivable (AR) management, you might find yourself struggling with overdue payments and delinquent accounts sooner or later.

But you can evade this risk when you have an AR specialist on staff or an expert outsourced service partner to take care of your invoicing and payments.

What is Accounts Receivable?

The accounts receivable definition in simple words: AR refers to the future cash flows a company expects to receive from the sales of its goods and services. It includes invoices issued to customers for products or services delivered but not yet paid for.

Accounts receivable (AR) is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Any amount of money owed by customers for purchases made on credit is AR.

Source: Investopedia

When payment is received for the invoice, you will debit your accounts receivable for that amount and credit your cash account.

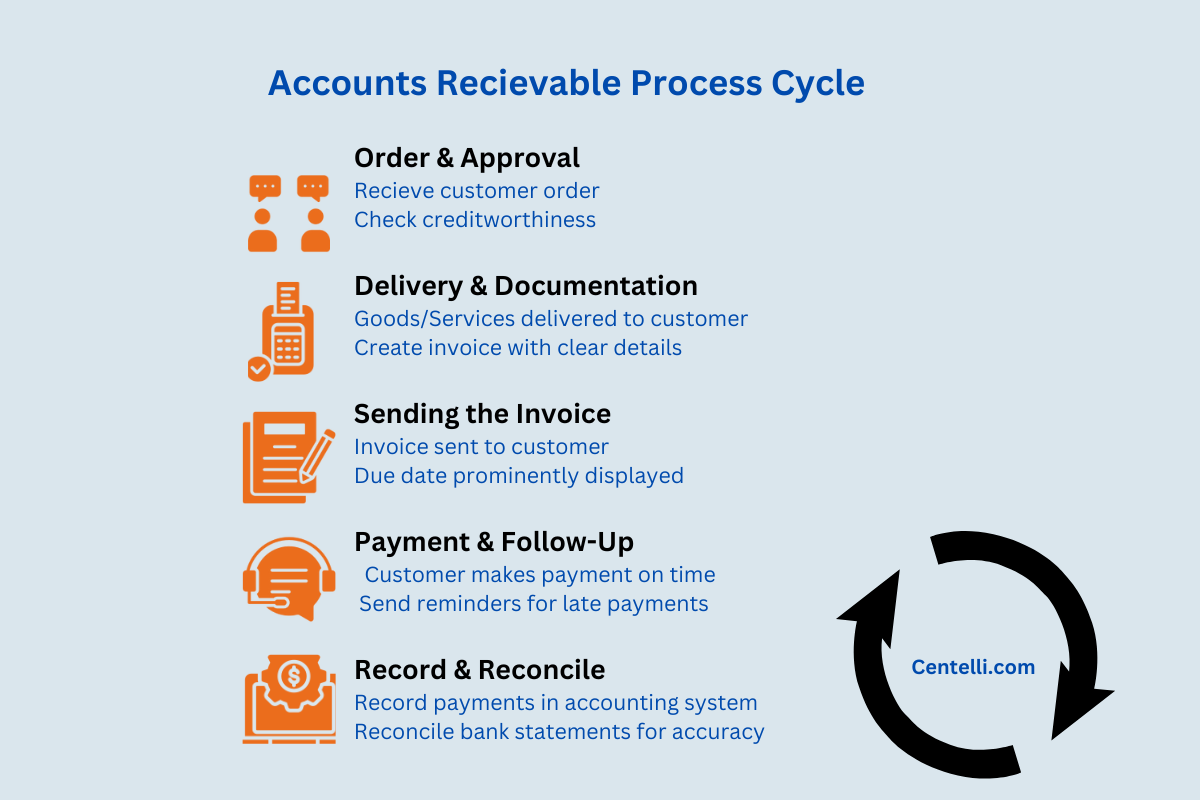

What is The Accounts Receivable Process?

The accounts receivable cycle begins when a product or service is delivered to the customer on credit and concludes with the collection of the payment.

Here’s how the accounts receivable process broadly looks like:

1. Setting Up Credit Policies

As a business, you need to establish clear credit terms, including payment time, credit limits, and interest rates for your company’s accounts receivables. Additionally, you must develop a solid credit policy outlining the processes for evaluating debtors through credit checks.

However, ensure the policy isn’t so stringent that it affects your business’s profits.

2. Invoice Issuing

Generating the customer invoice comes next once the customer order is received and confirmed, and the credit terms are finalized.

Notably, the invoice should include the following details:

a) The agreed-upon payment due date.

b) Detailed descriptions of the products or services, including relevant product information and usage.

c) Pricing details, including any discounts.

d) Clear instructions on payment methods and how to pay.

e) A unique invoice number for internal categorization and tracking.

Please note the invoice should be sent to the customer within the specified timeframe. Because delays will disrupt your overall accounting cycle and finances.

Furthermore, consider offering subscriptions to optimize your cash flow. Upfront payments from customers can also help maintain a healthy cash situation.

3. Collecting Payments

Collecting payments or dues is one of the most crucial steps in the accounts receivable process. Therefore, as soon as the invoice reaches your customers, you need to act proactively and effectively to ensure timely collections.

Importantly, your AR collection efforts should include the following:

a) Minimizing risks from failed or late payments. offering early payment discounts helps!

b) Creating a collection map by segmenting individual customers based on their payment history.

c) Regularly monitoring customer engagement and setting up personalized workflows.

d) Empowering your AR team with predefined email templates for quick editing and use.

4. AR Report Maintenance

To fully ensure the effectiveness of your AR process, you must maintain up-to-date records of all received and due payments. These insights will provide clarity and empower you to make informed business decisions.

Notably, manual data entry or report generation can be quite time-consuming and error-prone. Automation can help speed up invoicing and payments, minimize errors, and enable effortless tracking. Let’s dig in more!

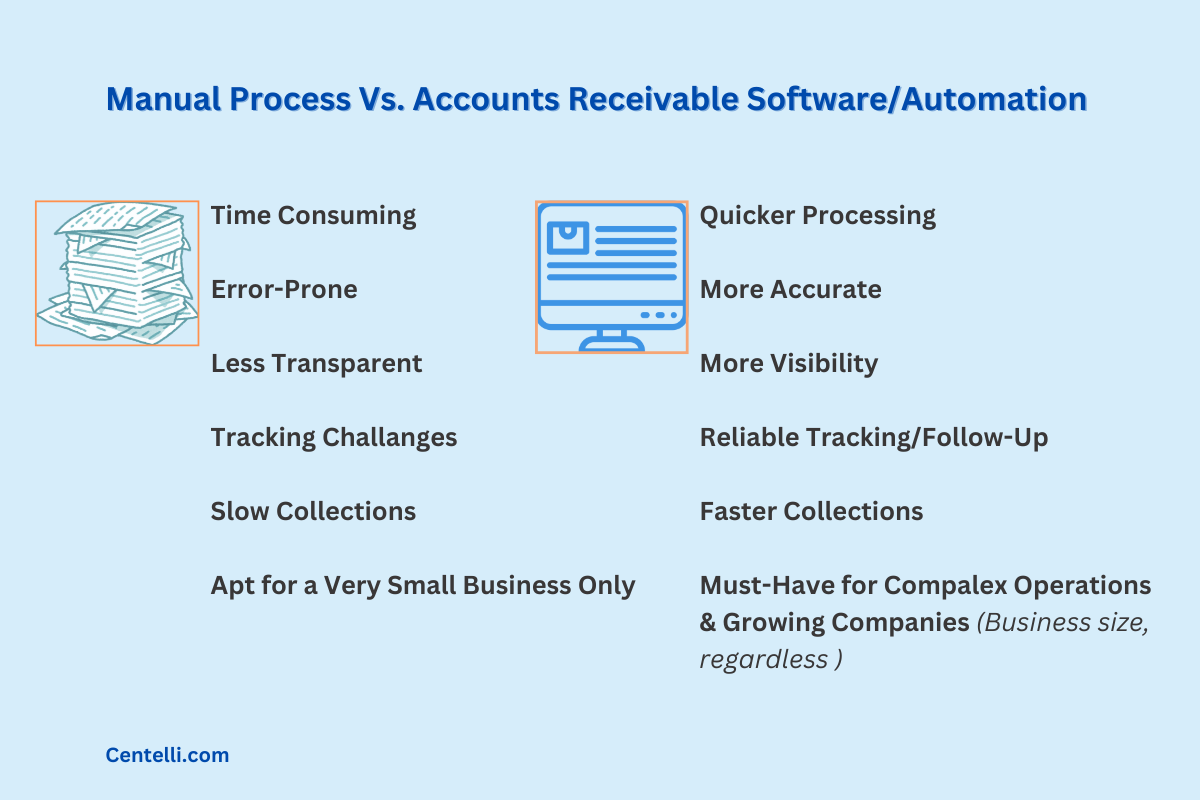

Accounts Receivable Software/Automation vs. Manual Processes

A manual accounting system might suffice for a simple business but falls short for complex operations and high-volume transactions. AR automation software eliminates the manual handling of repetitive processes like data entry, invoicing, reconciliations, and payment reminders.

However, you need human experts for interpretation, decision-making, and customer relations management.

Some notable benefits of using accounts receivable automation systems over manual handling include:

- Digitalization saves time and effort—manual data entry is indeed tedious.

- Invoice processing software ensures more accurate invoice amount calculations, helping to avoid reworks and disputes.

- Improve cash flow by simplifying collection management and ensuring accurate invoice data.

- Efficiently track cash flows and overdue invoices.

- Enhance collection efforts through automated payment reminders and entries.

- Get accurate AR reporting, including aged debt reports.

Contact us for a no-strings-attached consultation if you are seeking a reliable accounts receivable service! Centelli is a full-service accounting service provider offering bespoke solutions that align with your business needs and operational budgets. Our accountants are deft in leading AR software such as Sage, NetSuite, Xero, QuickBooks, and FreshBooks, to name a few.

In Summary

Accounts receivables are (current) assets to your company, contributing to the green on your balance sheet. As a savvy business owner, you are undoubtedly aware of their critical importance.

Yet, we’re here to reiterate the intricacies of the process itself. Because keeping track of your credit sales requires a delicate balance to collect money effortlessly and on time.

However, you may not have enough in-house resources or time to manage it all by yourself.

You May Also Like: Effective Accounts Receivable Management: 15 Signs You’re on Track

If so, hiring an experienced accounts receivable outsourcing service makes sense to achieve streamlined and more effective operations.