- Accounting Services

- Written By Namita Bhagat

Accounting Talent Shortage: How Outsourcing Can Help US Businesses Counter the Crisis

13-Sep-2023

The US Accounting talent shortage is turning into a looming crisis. Many businesses, CPA and accounting firms are experiencing staffing challenges. It’s becoming arduous to recruit and retain qualified accounting staff.

So, you risk being understaffed or having to make do with the under-skilled!

Juxtaposed to this deficit, the demand for accountants and auditors continues to soar. The demand may grow by 4 percent from 2022 to 2032, according to the US Bureau of Labor Statistics (BLS). Which means an estimated 126,500 new accounting job openings each year.

Notably, many of these vacancies, says the BLS, will be the result of retirements and occupation change. Hence, there’ll be a need to replace the outgoing employees with new ones.

In this blog post, we’ll discuss the factors fueling the accounting talent gap and its impact on businesses and accounting firms. We’ll also talk about how outsourcing can help companies address and surmount the accounting talent pipeline challenges.

Understanding the US Accounting Talent Gap and Its Reasons

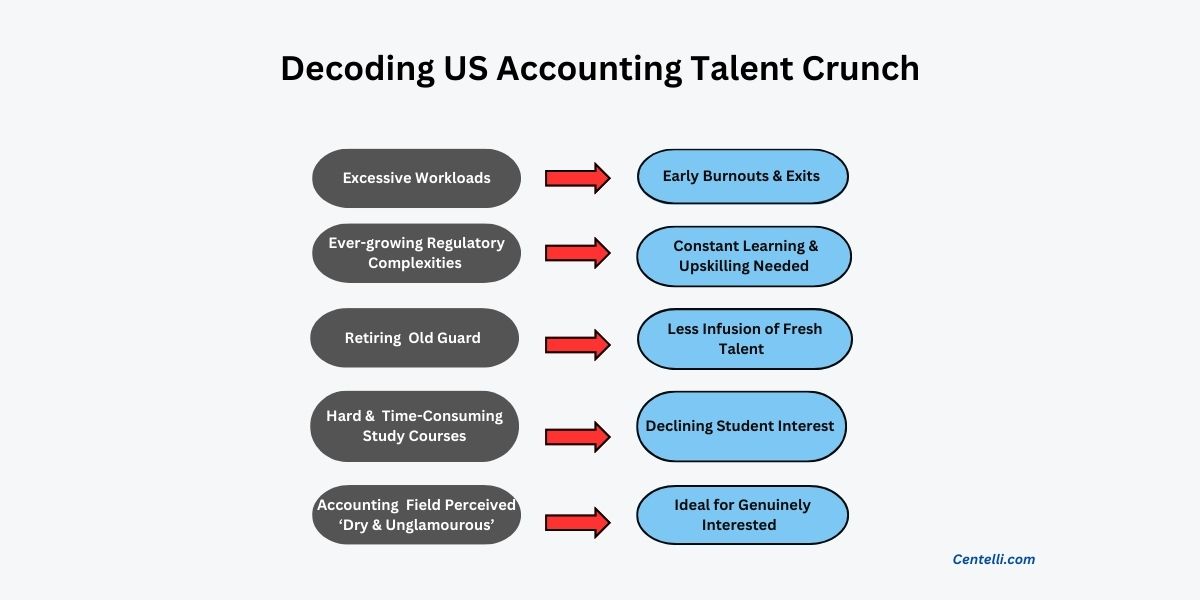

Let’s examine why’s there a shortage of accountants in the first place. Here’re the top five factors contributing to the widening talent gap:

- Mounting Workloads: Less people, excessive workloads, and long work hours. So, employee burnout is one of the primary reasons why accountants are quitting.

- Ever-Changing Regulations: The financial and accounting regulations are becoming complex. Constant learning and upskilling are essential, which is not everyone’s cup of tea.

- Retiring Workers: The shortage is being exacerbated by the retirement of experienced workers. But there’s a lack of fresh talent entering the field.

- Fewer Students: Accounting and CPA courses are tough and time-consuming. Fewer students in the US are opting for these.

- Career Perception: Accounting is typically seen as a dry, technical, and unglamorous field. It doesn’t appeal to everyone. But those who are genuinely interested in it can find success and fulfillment.

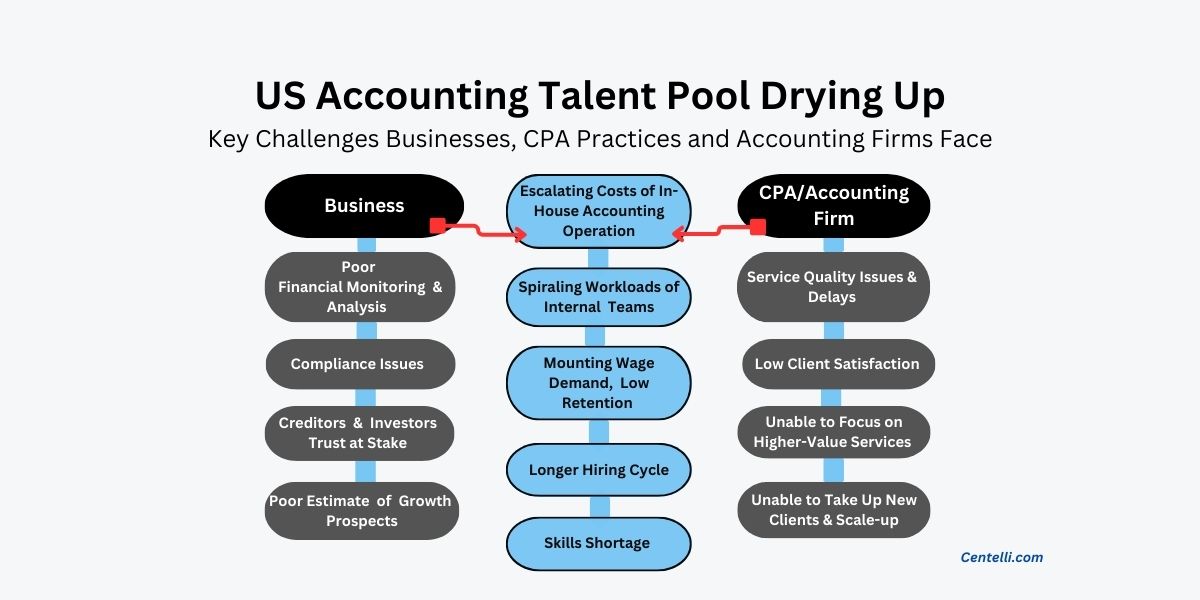

The Impact of Accounting Talent Shortage on Businesses

In-efficient accounting processes can lead to poor financial monitoring, planning and management. [Here’s an example how the chips may fall off!].

Below are some key challenges a business might face due to accounting talent crunch:

- Excruciating workload on existing workers

- High wage pressure adding to business expenses

- Increased operational costs of in-house accounting department

- Poor skills and lapses leading to elevated risks of errors and fraud

- Compliance issues due to accounting errors or inadequate reporting

- Budget estimations, fund-raising, investment and growth planning may go wrong.

The Impact of Accountant Shortage on Accounting and CPA Firms

CPA and accounting firms may experience slightly different challenges than a business organization. But the underlying theme of process inefficiencies and risks thereof remains the same.

Some potential difficulties these firms could face due to accounting talent shortage:

- Poor client accounting service quality and delivery delays

- Diminishing client satisfaction and loyalty

- Inability to focus on high-value services, which can limit earning potential

- Increased hiring, training, and retaining costs

- Constraints on accepting new clients and scale-up

- Inability to service more clients during busy tax season

The Challenges of Hiring Accountants in Short Supply

The scarcity of skilled accountants and bookkeepers is resulting in longer recruitment cycles. The vacant positions are putting extra pressure on the existing workforce and workflows as a result.

Furthermore, there’s a growing trend of remote and hybrid work culture, too!

Markedly, the phenomenon began as an exigency measure in ‘Covid’ times but has stayed on in the US and worldwide. But many organizations aren’t equipped or inclined to pursue a hybrid workplace. In some cases, it’s not at all workable. This also adds to accounting staffing problems.

The current situation presents a formidable challenge particularly for early-stage, small, and mid-sized companies. Many CPA firms and accounting services are also struggling to service their clients adequately.

How Can Outsourcing Help Ease Accounting Talent Shortage?

Accounting plays a critical role in monitoring and upkeeping a business’s financial health. Precision and timeliness are the foundations of a seamless and output-driven accounting process.

But we all know that daily accounting is time-consuming as well as labor-intensive. Occasions like tax season, fundraising, or scaling up also mean overwhelming workloads. And you can’t afford any lapses as a business. Imagine dealing with the scarcity of manpower in these critical times!

Businesses and accounting firms can, however, ease such bottlenecks through outsourced accounting services. They come with several benefits:

- Specialized Expertise: Outsourcing providers can provide businesses with access to specialized accounting expertise. It’s a great advantage when not available in-house. Particularly useful for complex accounting tasks, such as tax planning or financial reporting

- Accuracy & Efficiency: A competent outsourcing services company maintains proper infrastructure and expertise. They deploy market-leading accounting software and technologies. It helps in improving accuracy and avoiding costly mistakes, moreover

- Cost Optimization: Accounting services have access to a larger talent pool. So, they’re able to offer lower rates due to economies of scale. In-house accounting department, on the other hand, can be more expensive.

- Scale-up Support: A lack of focus can hinder business growth. Outsourcing allows businesses to focus on core activities, facilitating expansion and growth, however

- Improved Compliance: Outsourcing services stay abreast of the latest accounting regulations. Which also helps their clients stay on top of compliance

- Agility & Scalability: The outsourcing model allows for an agile accounting function. It offers flexibility to delegate the entire accounting process or parts of it to an outside agency. A company can sign up for flexible services packages specific to their needs and scale as required.

Outsourcing to a global BPO destination can help in massive savings. Offshore outsourcing hubs, such as India, the Philippines, among others, can be an ideal choice. The robust dollar and lower labor rates in these countries make cost-efficiency a valuable proposition.

The Steps Involved in Outsourcing Accounting

Choosing an accounting service provider is a crucial milestone of outsourcing journey. When choosing one, consider the following:

- Identify your specific needs and requirements, such as desired services and expertise levels

- Get quotes from service providers to compare prices and services

- Check references and reviews of past clients

- Check registration and certifications of the services provider

The steps for outsourcing accounting vary depending on the service offerings and need. Common steps include:

- Meet with the outsourcing provider to discuss your needs and assess compatibility

- Select the services aligned with your business needs

- Set up the account. Transfer data (the service provider can guide and handle it)

- Track progress to ensure a smooth process

Partnering with an expert accounting outsourcing services not only helps close the accounting talent shortage gap but also realize a stable process. Which also means that the business owners, their managers and internal teams can better focus on other functions.

Is your business struggling to find and retain qualified accounting talent? Let Centelli handle your accounting needs. Our UK-based team of GAAP-compliant accountants provides bookkeeping and accounting services with expertise and care. Book your free consultation today and learn how we can help you!

In Conclusion

The exodus of accountants and dwindling number of accounting students indeed is alarming. There’s a need for US accounting bodies and think tanks to reimagine ‘how can we make accounting cool’? However, it seems like accounting talent shortages are not going away anytime soon.

Outsourcing presents a viable solution to counter accounting talent shortage crisis. Markedly, US enterprises have been outsourcing finance and accounting to global offshore destinations for years. Now small and mid-sized businesses, accounting and CPA firms are also taking to this idea.