- Bookkeeping Services

- Written By Namita Bhagat

Small Business Bookkeeping Guide (Simple and Practical Tips)

04-Sep-2023 . 7 min read

Whether you’re a seasoned small business owner or a new entrepreneur, you may find this ‘Simple and Practical Guide to Small Business Bookkeeping’ immensely useful.

- In this guide, we’ll dive into the intricacies of financial record-keeping, explore different approaches, and provide essential tips for keeping your books organized.

- We’ll also shed light on the importance of hiring an expert bookkeeper and how to find a reliable bookkeeping service if you’re looking to outsource.

Read on to embark on your journey to achieving flawless and truly effective bookkeeping, contributing to your business’s success.

Business Bookkeeping at a Glance

The Need for Bookkeeping

Simply put, bookkeeping pertains to the record-keeping of financial activities and transactions by the business in a systematic way. These include money flows (via cash and checks), customer invoices, purchase receipts, supplier bills, etc. Additionally, there can be entries for bank reconciliations, tax filings, credit and loan details.

Importance of Bookkeeping for Small Business

Maintaining precise financial records is crucial for small businesses, just as it is for large enterprises. It enables tracking and monitoring of cash inflows and outflows, helping companies stay informed about any financial challenges and take proactive steps to mitigate them. Additionally, it provides a comprehensive view of their profit (or loss) situation.

Using Software & Tools for Bookkeeping

Paper-based way of bookkeeping is now almost passé. With the advent of various bookkeeping and accounting software, platforms, and digital technologies, modern bookkeeping for businesses of all sizes has undergone significant changes. It has become faster and error-free, saving both time and labor.

Importance of Good Bookkeeping in Small Business

Proper bookkeeping ensures accurate financial records, aids in timely tax filing, supports strategic planning, and enhances credibility with stakeholders. It helps you identify cost-saving opportunities, prepare an optimal budget, and build the most effective strategies for scaling up your small business.

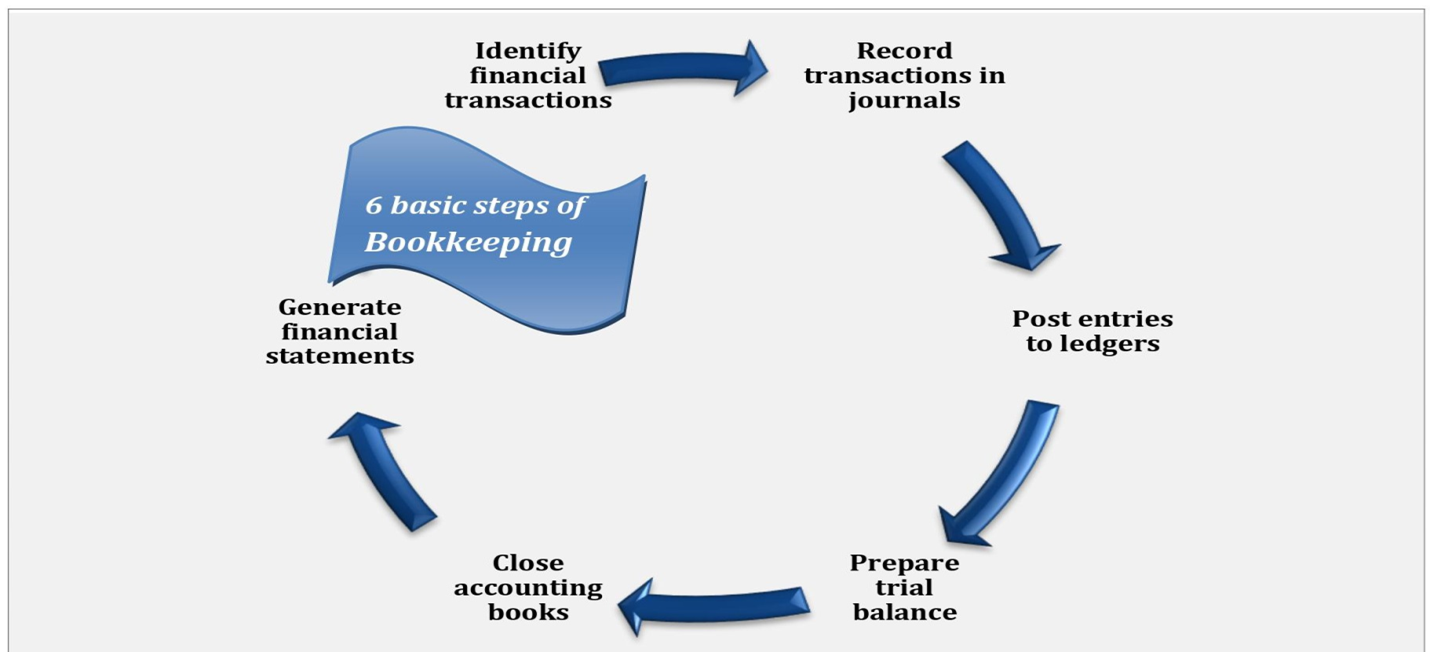

Breakdown of Basic Bookkeeping Process

All big and small companies go through these basic steps of bookkeeping in their accounting cycle:

- Classifying financial transcations

Transactions can be classified as purchases, sales, payments, and receipts. The general ledger is the primary accounting record, consisting of journals for initial transactions and financial statements for income, expenses, and the balance. Also, there are sub-ledgers for individual accounts, such as accounts receivable or payable.

2. Recording transactions in journals

Double-entry bookkeeping provides a better estimation of a business’s financial status. Importantly, it maintains a sequence for journal entries. Additionally, the bookkeeper should not skip any detail, whether it be the date, accounts involved, amount, or description. Similarly, the total of credits should be equal to the total of debits in an accounting cycle.

3. Posting transactions in ledgers

Once journal entries have been recorded, the next step is to post them to their respective ledger accounts. The process involves recording each debit and credit in the related account, resulting in updated totals. By doing this, preparing trial balances and financial statements becomes easier.

4. Preparing trial balance

Balancing your books involves ensuring that total debits and total credits in the general ledger match. This is done through trial balances, notably. If imbalances exist, errors are identified and corrected to ensure accurate financial reporting.

5. Closing the books

Closing the books at the end of an accounting period is a crucial step to maintaining precise and current financial records. It thus paves the way for producing various financial statements.

6. Preparing financial statements

Preparation of the profit and loss statement, balance sheet, and cash flow statements provides a comprehensive overview of financial activities and business performance over a specific period.

Keeping books for a small business demands diligence, and the importance of the bookkeeping process to stay on the right track cannot be undermined!

What’s the Right Bookkeeping Method for You?

Are you unsure whether to use cash or accrual basis when bookkeeping for your small business? Let’s compare the two!

The cash basis of accounting records revenues upon cash receipt and expenses upon payment. In contrast, accrual basis bookkeeping records transactions as they occur, regardless of when the cash flow happens. As a result, the latter provides a more comprehensive overview of financial activity.

To simplify things, many small businesses start with cash-based bookkeeping. However, large or more complex businesses use accrual bookkeeping for tracking ongoing obligations and revenues.

Note that when choosing the right bookkeeping method for your business, it’s crucial to weigh the pros and cons of each approach to determine which is best for your business needs.

Importance of Bookkeeping for Tax Confidence

Here’s a quick run-down of how accurate bookkeeping can help a small business improve tax compliance, avoid penalties, and reduce its tax liability:

- Track your income: Proper bookkeeping is crucial for accurately recording all your income. This helps in calculating your taxable income.

- Estimate tax payments: By maintaining accurate records of your income, you can calculate and pay estimated taxes without fretting over the deadline. This prevents underpayment penalties.

- Minimize tax liability: Regularly updated books enable you to track expenses and deductions that can be claimed on your tax return. This helps minimize your taxable income and ultimately your tax liability.

- Maintain documentation: Having well-organized and complete documentation can substantiate your tax claims and deductions. Organized records also come in handy during audits and inspections.

- Improve compliance: Good bookkeeping ensures that you have records that meet tax authorities’ requirements, which helps in improving compliance. This helps in avoiding errors or discrepancies that could trigger audits or penalties.

- Avoid Penalties: Poor bookkeeping practices can lead to several financial and legal consequences, such as tax errors, lost deductions, late filings, and subsequent fines.

Why You Need an Expert Bookkeeper For Small Business and Start-Up

Start-up founders and small business owners may find bookkeeping burdensome, especially when they are caught up in other business activities. Hiring a bookkeeping expert can alleviate their workload and ensure their accounting books are accurate and up to date.

Additionally, a skilled bookkeeper can also help your business save money, increase revenue, and track financial obligations for informed decision-making.

Signifcantly, a growing number of businesses are now hiring professional accounting and bookkeeping services.

Because by entrusting your processes to outsourced bookkeepers and accountants, you can confidently shift your focus to other critical areas of your business!

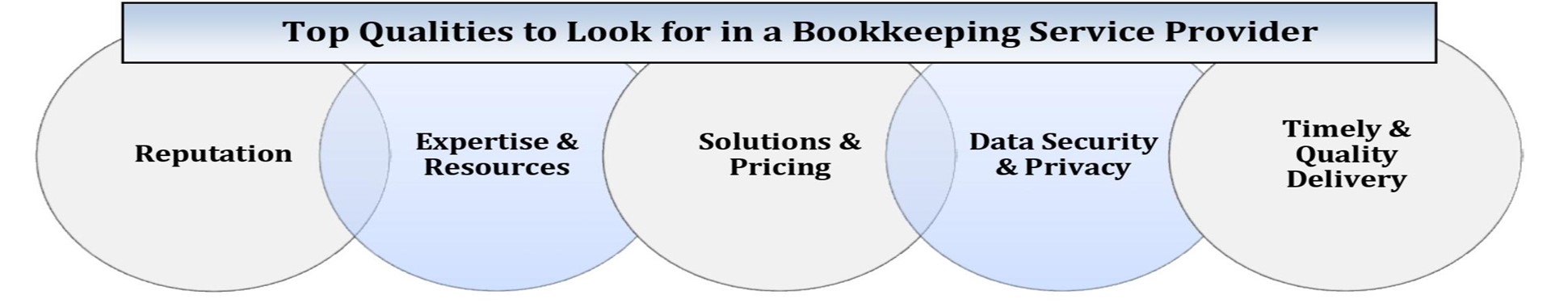

Finding a Reliable Bookkeeping Services for Small Business Accounting Needs

There are several points business owners need to consider when looking for an outsourced small business bookkeeper. These seven tips can help you pick the right service:

- Do your research: The first step entails online searching, seeking recommendations, and checking directories. Furthermore, consider reaching out to professional networks or industry associations for insights and referrals.

- Verify professional competency: Make sure the bookkeeper has the relevant qualifications and experience to meet your requirements, notably their professional background and certifications.

- Check reviews: Review feedback from other clients to gain insight into the quality of their work. However, sift through the feedback to discern biased and unbiased perspectives.

- Consultation/Interview: Interviewing your potential service provider is a great way to discuss your needs and learn about their services in detail. (You can book a free consultation with Centelli to learn how our SME bookkeeping solutions can help you)

- Software expertise: Verify that the bookkeeper can deftly work with the small bookkeeping software you use. (Our team is skilled in QuickBooks, Xero, Wave, FreshBooks, Sage, NetSuite, Microsoft Dynamics, and more.)

- Discuss pricing: Learn about the service costs or charges and ensure they are within your budget. (At Centelli, we a follow fair and transparent pricing policy.)

- Communication & Safety Protocols: Data safety and confidentiality are of crucial while bookkeeping for small companies, too. You must ensure your service provider follows robust data protection measures and communication protocols.

- Terms & Conditions: Before signing the service-level agreement, you need to fully understand the scope of services, expectations, confidentiality, terms, and conditions. It’s a must-do!

Key Takeaway

Proper bookkeeping is non-negotiable for a small business’ financial health. However, accurate recordkeeping is only possible with timely tracking of every important transaction, proactive supervision, and continuous monitoring.

Doing your own book keeping may not be feasible for many business owners, though. You have an option—outsource your process to the experts and reap the benefits of well-maintained books and an effective bookkeeping process.

Need small business bookkeeping help? Let Centelli handle everything for you!