- Accounts Payable Services

- Written By Namita Bhagat

An Overview of Accounts Payable Process Improvement

17-Mar-2023 . 7 min read

Every business needs to procure goods and services for its operations. These can include raw materials, machinery, office supplies, marketing and delivery partners, and more. Ensuring payment accuracy and timely bill-clearing helps you foster strong supplier relations. If it’s not up to par, it’s time to undertake an accounts payable process improvement exercise! If it’s not up to par, it’s time to undertake an accounts payable process improvement exercise!

Sure, you might find it challenging, but it is much needed nonetheless. Let’s discuss some steps you can take to level up accounts payable (AP) and maintain a healthy cash flow—always.

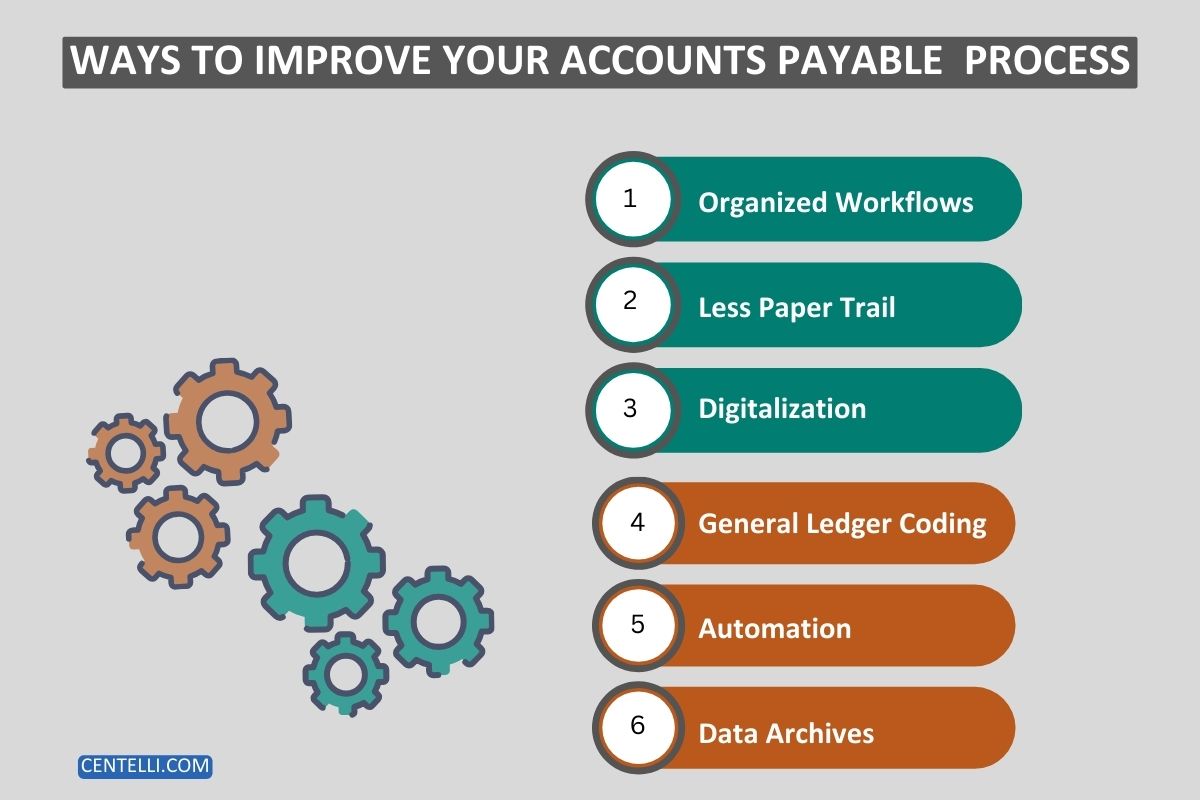

Ideas for Accounts Payable Process Improvement

Inefficient AR process flows can hurt your business’s reputation, supplier relationships, financial planning, and decision-making. Do this to simplify and streamline your payments to avoid these issues and save yourself the trouble.

1. Improve Accounts Payable Process Workflow Organization

Orderliness is the key to an effective process, including accounts payable. You should develop a robust method for handling invoices from the time you receive a bill until the time you pay it. Store all invoices in a central location so that you can quickly locate them.

You should also prioritize invoices by due date. For example, you can arrange bills by due date, with the closest due dates first.

You can use an accounts payable aging report to track invoice due dates. An AP report will help you identify vendor invoices that are past due payment date.

2. Go Paperless; Adopt Digitalization for Faster AP Process

This step is highly recommended for elevating accounts payable process efficiency. One of the biggest challenges buisnesses face today is managing paper-based documention. Even though an increasing number of invoices are processed electronically, some are still printed on paper.

This happens even in organizations that receive electronic invoices. It not only adds printing costs to business expenses, but you may end up spending considerable time to locate the documents.

Further, it can also be quite costly to store the paper invoices for record even after they are paid. Besides cost-inefficiency, there’s also a risk of damage like decay and fire.

Documents often need to be sent to other departments for information sharing, encryption, or response. Photocopying can add to the distribution costs and may be lost or delayed before reaching the desired destination.

Data digitization and electronic data transfer are a better option for this reason.

When you implement digital solutions, you can eliminating the paper trail. By eliminating paper, you will be able to reduce printing costs, conserve hours, and save office space. Consequently, you can achieve a time and cost-efficient invoice payment process.

3. Reduce Data Entry Errors to Improve Trade Payables

Incorrect data entry can ruin any chance of improving your accounts payable process efficiency. One study found that 88 percent of Excel spreadsheets contain errors. These errors can be mechanical, logical, and omission.

Even small errors can be costly for your business. Imagine how much time and money you may need to spend to fix them or for dealing with the aftermath like delayed payment penalties.

Notably, manual entry is the most common cause of data entry errors. You can lessen the chances of mistakes by automating data entry.

4. Use GL Codes to Reduce Accounts Payable Processing Times

Even in companies with an ordering system, some invoices still need to be approved and coded before they can be paid. Having an effective general ledger (GL) coding system in place ensures that all account payable transactions get recorded accurately.

It allows you to assign a unique GL code to each financial entry, helping improve overall accuracy, tracking and reporting.

Importantly, coding can be made easier for non-finance-related users handling data. Sophisticated defaults and lists based on departments or vendors make coding easy.

One key benefit of this strategy is that it can speed up the process by eliminating the need for the accounts payable team to review and potentially reject paper forms. Furthermore, you can automate GL coding to effectively cut down your processing times and level up the payable process as whole.

5. Don’t Loose Track of AP Invoices; Set Reminders

You should make a conscious effort to organize your creditor accounts. It is easy to over look payments and allow some outstanding invoices to go unnoticed. So, it helps if you set up reminders for your pending bills before their due dates expire.

It also helps you anticipate upcoming expenses!!

You can use a calendar to manage invoice due dates and set alarms to automatically notify you when due dates are nearing. Also, you should review your payables regularly to make sure you don’t miss any bills.

Want to save the hassle of managing your accounts payables all by yourself? We provide expert accounts payable outsourcing services to businesses of all sizes. Contact us to learn how our accounts payable process improvement ideas and solutions can help you.

6. Accounts Payable Transformation with Automation

Notably, inefficient purchase invoice processing can kill your supplier relations, causing disruption to service and supply lines. You may be forced to look for new suppliers as a result.

You can, however, level up your process by using an accounts payable (AP) automation solution. In addition to providing touch-free straight-through processing for most invoices, it also helps highlight issues for the accounts payable team to resolve swiftly.

Automation can take your account payable process improvement to a whole new level!

No more manual invoice processing means eliminating the chances for errors and inefficiency. It also helps prevent document losses and ensures timely invoice processing.

7. Better Archiving of Accounts Payable Transcation Process Data

One of the most efficient ways to improve your accounts payable management process is to track your invoice data!

When you receive an invoice, store it electronically as a PDF or other document format. This includes invoices, purchase orders, receipts, and supplier notifications.

These documents will help you pay invoices accurately. They will help you know when each invoice is due, who you need to pay, how much you need to pay, and what you are paying for.

Furthermore, you can refer to these documents for preparing your business tax return. It also helps to have a streamlined accounts payable process to answer any query about invoices when asked by the authorities.

8. Flawless AP Operation for Healthy Supplier Relations

Regular interactions with your suppliers are vital to improving accounts payable process efficiency. Building trust with your vendors can go a long way. Strong vendor relationships can help you with a variety of issues, such as needing emergency supplies or delaying due dates.

Make sure to pay your vendors on time. If you are unable to pay for some unforeseen reason, be honest about the situation and inform them as soon as possible. Work with your vendor to find a payment plan that you are both comfortable with.

You get better bargains on the goods and services you need when you have solid vendor relationships. Furthermore, loyal associates are more likely to promote your business to others, so you can grow your network.

Final Note on Elevating AP Process

A successful business operation is powered by the collective success of many and various processes, including accounts payable. However, AP workflows can be complex and time-consuming.

You need to revisit them from time to time. Testing and deploying new accounts payable process improvement ideas can help optimize accuracy, cost, and time. You may also find outsourcing among the potent strategies to elevate your AP operation!